According to data from the country’s Central Bank, Pix has amounted to 34 billion transactions since 2020, figuring as the fastest-growing payment method in Brazil

Launched by the Central Bank of Brazil (Bacen) in November 2020, Pix was taken up by the country in record time. According to data from Bacen, payments made with the local alternative method over the last two years amounted to 34 billion transactions in 2022, summing a total 16 trillion BRL in transactional value.

In December 2022, Pix accounted for 3.8 billion BRL in transactions, incoming from 2.8 billion payments. It is safe to say holiday purchases on e-commerce played a part in these numbers. By mid-2022, local consultancy GMattos found Pix was enabled at checkout by 78% of online stores. Now, a new report updates this estimate to 91.5% – reinforcing Pix’s status among the most popular payment methods in Brazil, along with credit cards and boletos.

SEE ALSO: Explaining Pix for Gringos: A Comprehensive Guide to Brazil’s Instant Payment Method

Pix Payments for E-commerce: How does PagBrasil Pix differ?

Besides a growing banked population, the instant, easy nature of Pix factors heavily in its ascension. Outside Brazil, the rise of this payment method has even inspired prototypes of a “global Pix” for cross-border transactions – namely Nexus, developed by the International Bank of Settlements and currently in testing phase.

READ MORE: How Pix has influenced the digital payment realm in Brazil

Before riding this wave, though, it is important to notice that technical problems may delay Pix payments in e-commerce. Low-response platforms, browsing difficulties and faulty integrations with banks and payment service providers (PSPs) are examples of what may cause friction.

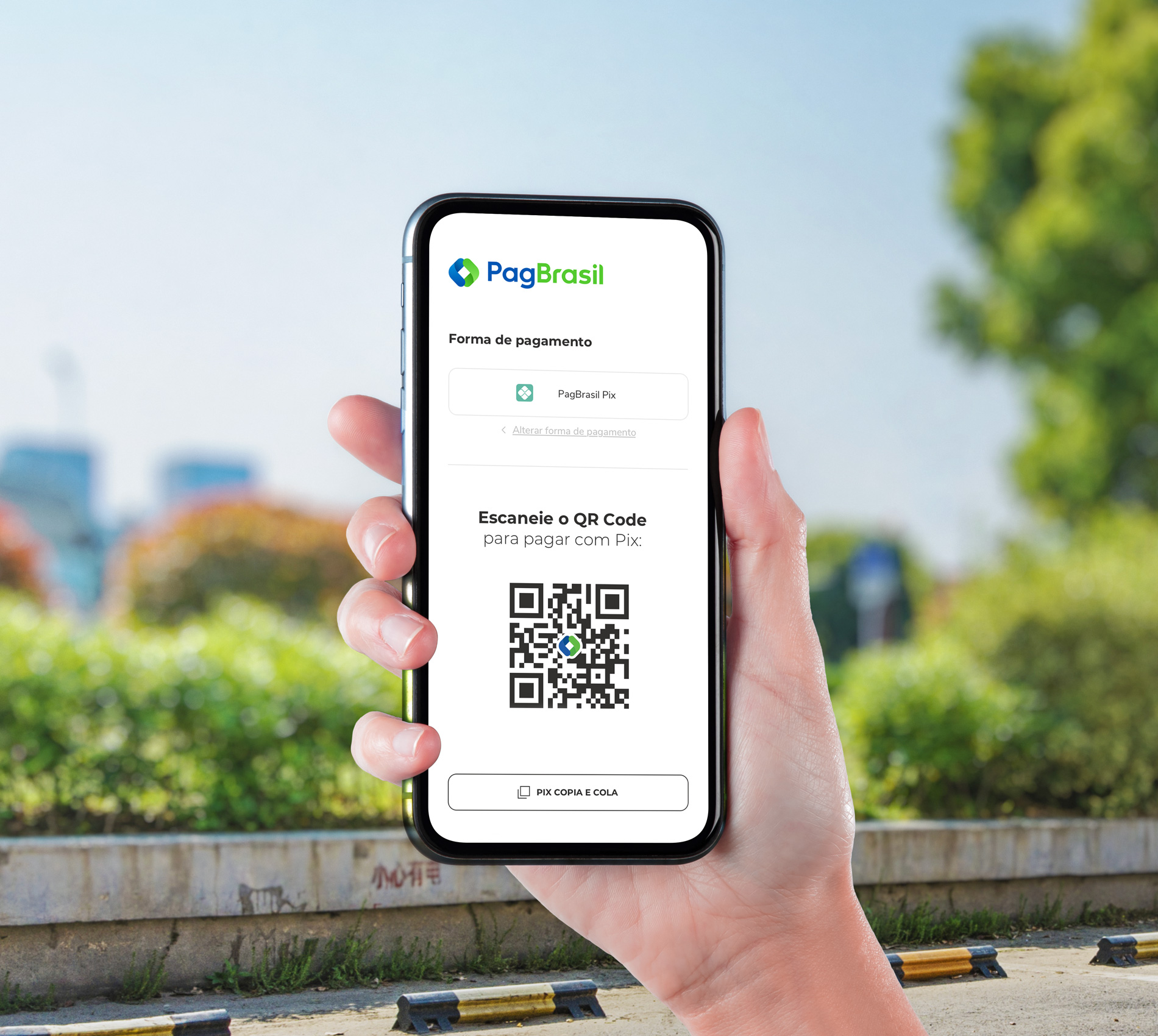

To counter these risks picking up on the e-commerce pace, PagBrasil developed PagBrasil Pix, an enhanced Pix solution which delivers the highest conversion rates in the market. Learn more about its benefits below and see how PagBrasil Pix improves the payment experience for cross-border transactions!

1. Improved, highly accurate conversion rates

PagBrasil Pix’s technology makes its payments actually instant, with conversions being registered by a pixel coded into the confirmation (“thank you”) page. This boosts conversions while also generating accurate data, making the payment process smarter for both customer and merchant.

2. Payment confirmation enabled by webhook

When Pix payments are delayed in e-commerce, customers are unsure whether to wait for confirmation or try for another payment. Merchants also may have to check manually for payment status in their database, to make sure the process went down correctly.

With PagBrasil Pix, the communication between the merchant’s and banking systems is automatically checked via webhook technology. In case communication fails, retries are made until payment confirmation is delivered.

3. Fallback to boost sales recovery

When Pix payments fail due to system errors in the customer’s bank of choice, the result is often an abandoned cart. Over time, these may pile up and escalate to a significant hit to the monthly conversion rate.

Friction at checkout also causes merchants to lose great opportunities to cash on impulsive-driven purchases, which might increase marketing costs and lead e-commerce ROI to drop.

As an independent PSP, PagBrasil has integrations to the largest banks operating in Brazil, enabling payment retries with different institutions in case of instability. Merchants can rest assured the fallback will warrant effective conversions and a quality payment experience for the customers.

4. Postponing of Pix expiration limit

Like boletos and credit card bills, Pix QR codes and payment links have a time limit to expire. With PagBrasil Pix, however, merchants can postpone the expiration limit for the customer’s convenience, without having to generate another code or link for redirection.

5. A Pix solution for subscription-based businesses

As of now, few subscription products and services can be paid with alternative payment methods such as Pix. However, merchants using PagStream® – our subscription management solution – can enable Pix payments for their customers via payment link. This helps boost conversion rates by making recurring payments simpler, being yet another way to ensure predictable revenue.

Get in touch and see how we can help to boost your conversion rates

To know more about PagBrasil Pix, you can browse all related contents on our blog and stay up to date. Check out a few more posts that might interest you:

- How Fintechs are Revolutionizing the B2B Payment Realm in Brazil

- 6 Things to Consider When Choosing the Right Payment Service Provider for Brazil [INFOGRAPHIC]

- Case Study: How NutriVita Got to More than 90% of Conversion Rates with PagBrasil

You are also welcome to reach out to our experts and see how Pix can benefit your business’s operations in Brazil. Contact us and let’s grow together!