In 2022, Black Friday in Brazil moved BRL 6,1 billion – approximately USD 1,2 billion.

Black Friday 2023 is a highly anticipated retail event for merchants and consumers worldwide, including Brazil. In 2022, Black Friday in Brazil generated BRL 6.1 billion in sales, equivalent to around USD 1.2 billion.

As Latin America’s largest economy, the Brazilian market is full of opportunities. But merchants looking to thrive in Brazil’s e-commerce market must also know the country’s particularities. An easy checkout and local payment methods are fundamental features to increasing conversion rates in Brazil.

To ensure a good ROI (Return on Investment) in your marketing efforts, online stores that sell to Brazil must be fully prepared to cater to local consumers’ needs.

This article will show you how to prepare your online store for a successful Black Friday in Brazil. Read on!

5 Ways to Increase Payment Conversions in Brazil for Black Friday 2023

According to a survey conducted by Globo with Brazilian consumers, 63% of respondents from the AB class intend to make purchases on Black Friday.

Although this number presents a great opportunity in e-commerce, it’s important to keep in mind that not all customers who access your online store with the intention of making a purchase can complete the payment. This includes cases such as customers who reached the final checkout stage, generated a Pix payment or boleto bancário, but did not complete the payment.

The reasons for this phenomenon can be many, such as instability, a checkout with too many steps, lack of payment method options… all these factors and more can ultimately contribute to an abandoned cart rate of up to 78%, according to OpinionBox.

Hence, ensuring that all payment steps are smooth and frictionless is essential to increasing e-commerce conversions. Check out our tips for boosting your sales in Brazil on Black Friday 2023!

1 – Offer multiple payment options

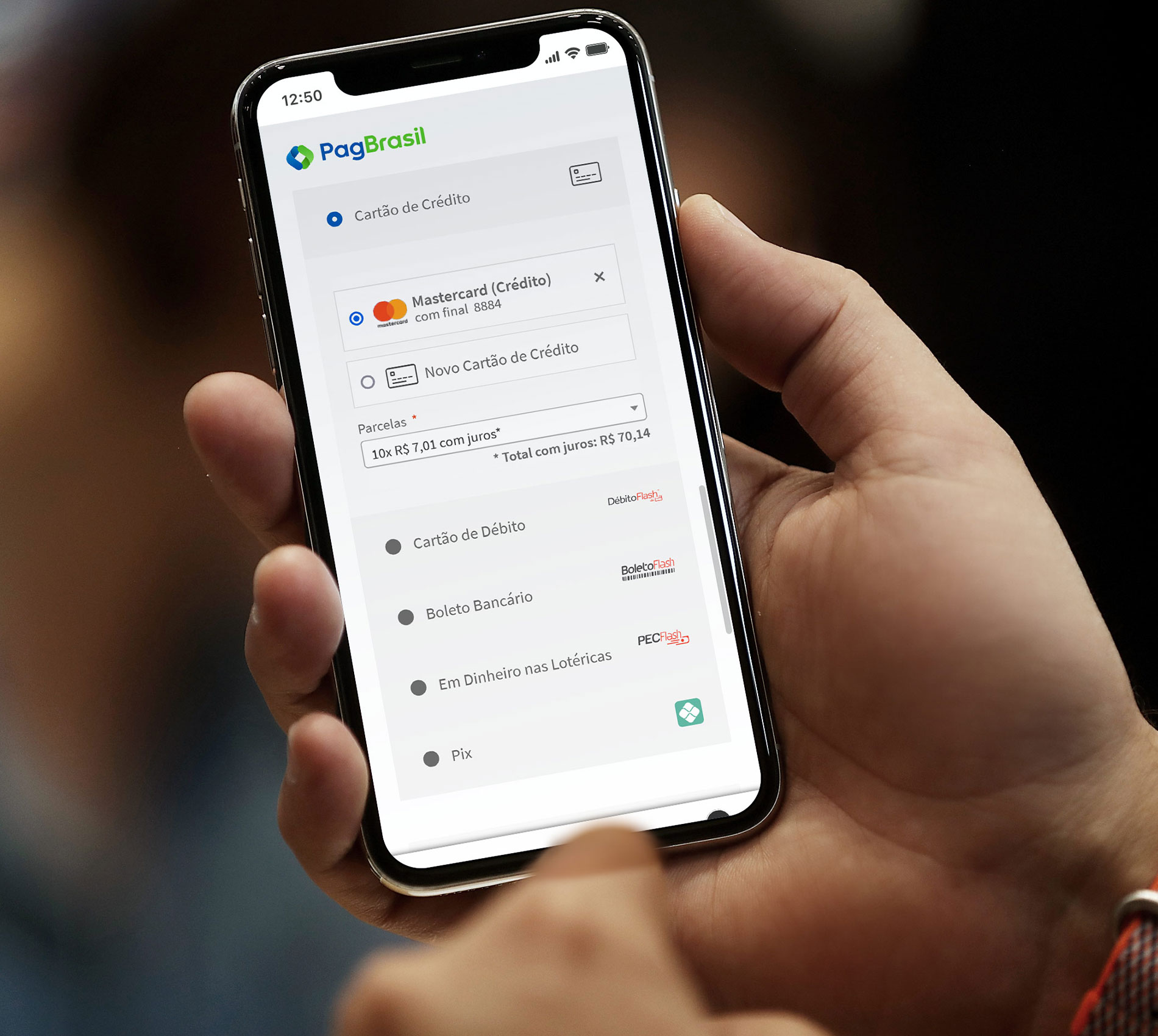

Local payment methods play an important role in Brazilian e-commerce. Installment payments with credit cards are consumers’ top pick when purchasing online, followed by Pix, Brazil’s instant payment method.

Also read: Pix: 10 Questions and Answers About Brazil’s Instant Payment Method

According to a survey carried out by OpinionBox, 17% of customers reported abandoning their carts because the online store didn’t offer the payment option of their preference. Providing a wide variety of local payment methods increases the likelihood of customers completing their purchases. It also guarantees customers an alternative option in case their first payment fails.

PagBrasil’s Pix offers enhanced efficiency and above-average conversion rates. Its multi-bank platform ensures high availability, webhook confirmation, and automatic resend of lost confirmations. Learn more here.

2 – Reduce checkout steps

A long checkout page can add more friction to the payment process, which is why it is important to simplify the checkout process and eliminate unnecessary fields and extra steps.

For example, features like address autofill and tax identification number validation can ease the payment process, as consumers can “skip” these steps – making their experience even smoother.

3 – Offer a direct checkout

A direct checkout ensures that your customer remains on the same page until they complete their purchase without being redirected to an external page.

This way, the entire payment flow occurs in the same environment, reducing friction and increasing the chances of completing the payment.

4 – Create a mobile-friendly experience

According to the E-commerce Trends 2024, 71% of respondents made online purchases using their smartphones. Further, in 2022, one-third of consumers in Brazil made in-app purchases during Black Friday, and 86% kept the app installed on their smartphones.

These numbers show the importance of mobile-first strategies for online sales in Brazil. Offering a positive mobile experience for your customers – through a mobile-responsive website or an app – can help your business boost conversion rates in Brazil.

5 – Work with a reliable and secure platform

Picture this: After successfully implementing all the necessary steps, investing in marketing actions and strategies, and successfully attracting a large number of potential customers, your website encounters technical difficulties that hinder the payment process and prevent successful conversions.

To avoid this scenario, it is crucial to work with a reliable platform that provides payment failure alternatives, such as:

Multi-acquiring

This technology, offered by some payment processors, enables online stores to connect with more than one acquirer, especially in gateway models – where the payment processor directly connects an online store with acquirers to facilitate settlements.

Having direct negotiation power with acquirers and a backup plan in case of technical issues benefits your site.

Fallback technology

Consider a situation where your customer attempted to make a purchase with Pix but couldn’t complete the payment due to a technical banking glitch.

If your payment processor is connected to multiple banks and there is an issue with a Pix transaction, a fallback option can be used to ensure your customer’s payment is completed. This means that alternative options will be explored to ensure your customer’s payment process is quick and smooth.

Infrastructure

During the Black Friday, website traffic spikes significantly. Therefore, it’s crucial that the chosen payment platform possesses a robust server infrastructure to handle traffic peaks.

Even with redundancies and stability-guaranteeing technologies, failures can occur. In such cases, it’s vital to have partners with technical availability to assist your store.

Anti-Fraud solution

An anti-fraud solution is crucial to minimize fraud and chargebacks. However, it should be implemented cautiously to prevent false positives that can reject valid transactions.

PagShield® is an intelligent anti-fraud tool designed for the Brazilian market. It uses machine learning and user behavior analysis to identify fraudulent transactions and reduce false positives. Learn more here.

What to Do After Black Friday?

After the busiest e-commerce period has passed, what’s next? Even after Black Friday, it’s possible to recover customers who didn’t convert during that time.

An effective strategy is to use a payment link to generate second conversion opportunities. Customers receive a pre-filled payment link via email or SMS containing their order details, allowing them to complete the purchase without returning to the site.

Another way to leverage the investment made during Black Friday is to find ways to retain these customers long-term. Investing in subscriptions, for instance, can be an excellent way to secure recurring revenue and optimize your CAC (Customer Acquisition Cost) and LTV (Lifetime Value).

Black Friday presents a significant opportunity for Brazilian e-commerce, but it also comes with its challenges. Adopting strategies to increase payment conversions is essential to make the most of this event.