Offering adequate online payment methods is an essential part of e-commerce businesses’ success. When it comes to Brazil, there are some particularities to consider: most of the credit cards issued in the country are not enabled for purchases in foreign currency, Brazilians are used to paying in installments, debit cards are not widely adopted in the e-commerce sector despite being very popular for card present transactions, and boleto bancário represents nearly a quarter of all e-commerce payments.

Choosing the payment methods to be made available at the checkout, as well as the payment provider, are important tasks. These choices can have a significant impact on the businesses’ gross revenue. For instance, our analysis show that by integrating Boleto Flash® with PagBrasil, as opposed to a regular boleto offered by Brazilian banks, there can be an increase of 10% to 20% in gross revenue.

Why Boleto Flash®?

The most common way to integrate the boleto bancário as a payment option in Brazil is contracting it directly with local banks – this is only an option for companies registered in Brazil, otherwise a local payment provider should be used. However, there are several indirect or hidden costs that elevate the price of the boleto payment processing with the bank.

Therefore, in addition to the fee charged by the bank, merchants must also take into account the overhead caused by – but not limited to – manual reconciliation (through what is called “francesinha” in Brazil), manual management of refunds, increased customer support (mostly due to low conversion rate) and increased cannibalization by credit card, which has higher costs in terms of processing fees as well as higher risk of chargeback.

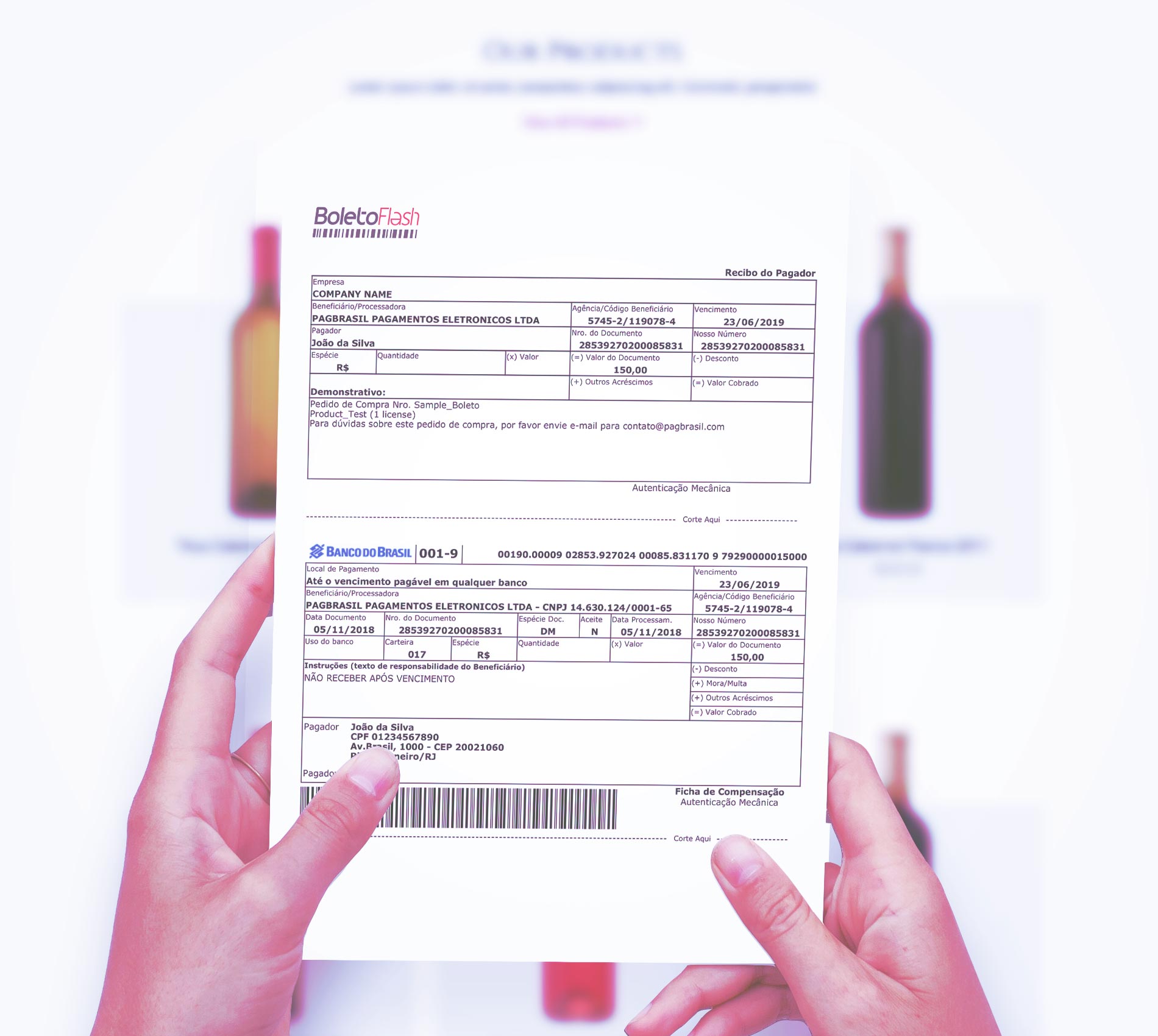

It is also important to highlight that because the boleto bancário was created before the advance of e-commerce, it is not fully adapted to the industry. For instance, a boleto provided by the bank is not adapted to in-app use, it can’t be retroactively extended, it has a non-responsive design, the payment confirmation can take up to three business days and it does not offer automated refunds. All of this leads to poor conversion rates. On average, only one in two boletos issued in the country are paid.

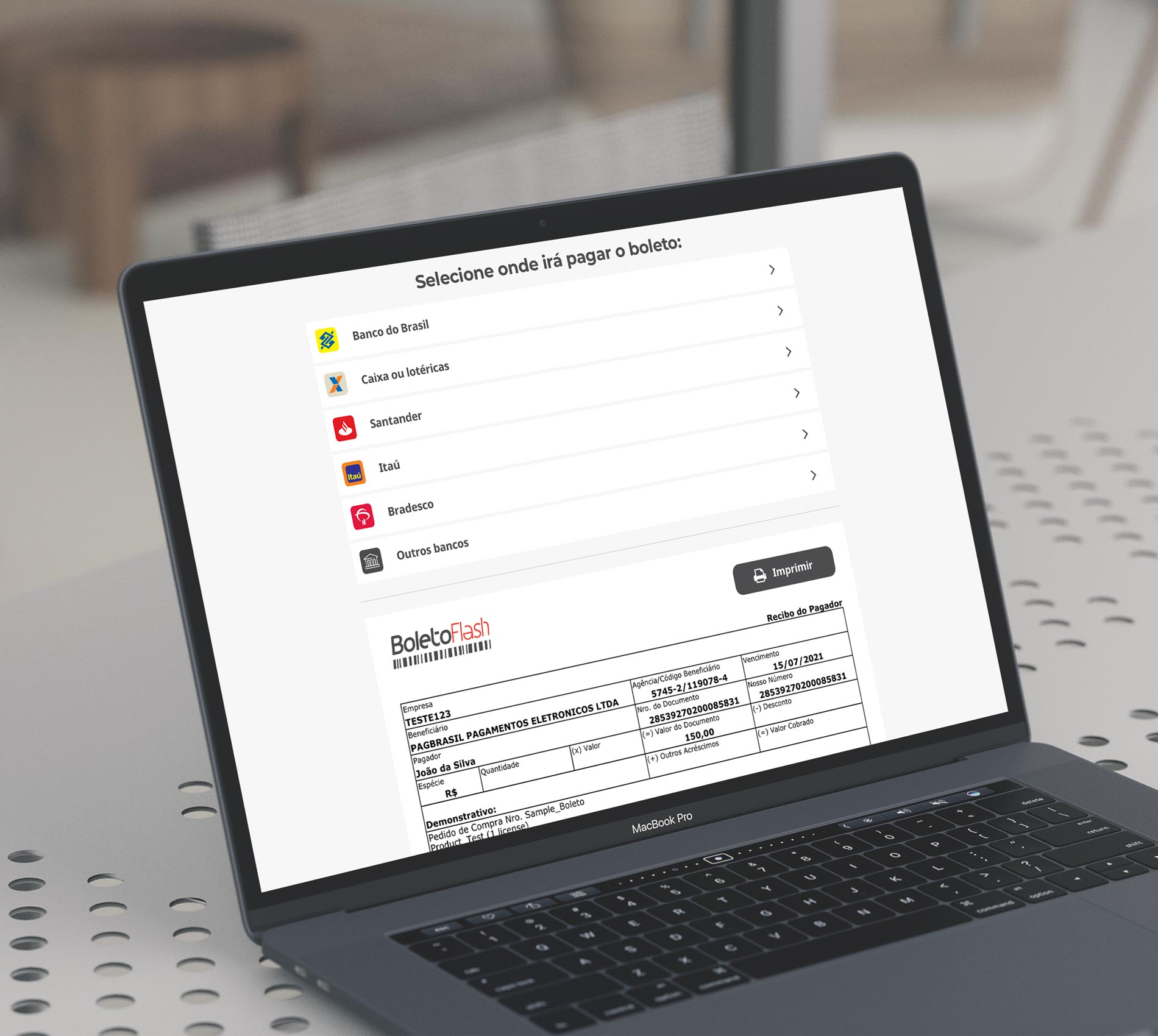

PagBrasil’s Boleto Flash®, on the other hand, was created with the sole focus of further driving conversions. Because of that, by default Boleto Flash® includes a responsive technology, making it easier for buyers to view and pay their boleto on their mobile device. In addition, it is the only boleto in the country that provides payment confirmation in under two hours.

Both features have a direct impact on conversion. The first one facilitates the checkout process so that the buyer has a more seamless payment experience on mobile devices, which are becoming the main internet connection source in Brazil. The accelerated confirmation plays an important role in the sense of immediacy observed by buyers. As impulsive shopping is very significant for e-commerce, when consumers can pay and get access to their purchases quickly, they are more likely to complete the payment.

Because PagBrasil’s boleto solution is optimized for the e-commerce industry, merchants who have activated Boleto Flash® as their boleto alternative have experienced an increase in conversion of up to 10%. In addition to the features mentioned above, PagBrasil also allows its boletos to be retroactively extended, offers automated refund and a series of additional services aimed at improving conversions. You can read more about our boletos as opposed to bank boletos here, and more about how to improve boleto conversion here.

How Can Boleto Flash® Impact Revenue?

Because of the hidden costs of processing boletos directly with the bank, in addition to lower conversion rates, businesses’ revenue can be affected. By using Boleto Flash®, merchants can see a positive result in their gross revenue, with an increase of 10% to 20% for boleto transactions, which has a great impact for businesses where boletos represent a big portion of the payments.

Comments

[…] PagBrasil’s platform: local credit and debit cards, boleto bancário – including the exclusive Boleto Flash®, the only boleto solution in Brazil that offers payment confirmation in less than one hour and […]

[…] Our Boleto Flash® is found to increase businesses gross revenue in up to 20% of boleto […]

[…] two hours. With Boleto Flash®, merchants can improve their conversion rates by more than 10% and boost their revenue by 10% to 20%. Other advantages […]