Providing special discounts has proved to be a working formula to increase sales, attract traffic to your store and more. Discover why you should consider special offers on payment methods.

Who doesn’t love discounts? Embedding a discount tag into a product can boost sales; it may help you sell products that have been sitting in stock for a while and encourage repeat visits.

Offering discounts on purchases is a way to draw people into your store quickly. You don’t need to offer a significant discount if you can’t afford it, but something as little as 3% or 5% already does the job.

Read more: 6 Essential Tools for Running Ecommerce in Brazil

Other than that, why should you bother to give discounts on products instead of full pricing that maximizes your profit? Let’s find out.

The benefits of offering discounts

The benefits of giving discounts to customers aren’t just boosting sales. From increased sales to improved reputation, discounts may be that one ingredient that can bring business success.

- Attract new customers: Maybe some possible customers hadn’t purchased anything from you before because they were waiting for a price drop. Providing discounts might increase your traffic and attract new buyers.

- Sell products high in stock: Discounting items may help you free up room in your inventory and finally sell some items that have been sitting on your shelf longer than you’d wish.

- Boost brand awareness: Since discounts are likely to drive more leads to your website, this will also automatically enhance brand awareness. Depending on the scale and how you advertise your product discount, you can effortlessly spread your brand to numerous prospects.

- Cash discounts save money: Your business can even save some money if you offer a deal per payment method. For instance, credit and debit cards result in additional fees on the merchant’s side, so if you provide a discount in payment alternatives that require no fee – in our case, boleto and Pix – you help both the customer and the business.

- Little to no risks of chargeback: Alternative payment methods such as Pix and boleto bancário are less likely to succumb to fraud or an error, thus decreasing the chances of chargeback.

Read more: 4 B2B Payment Trends in Brazil in 2022: More Interaction, Less Friction

Discounts per payment method

According to a study conducted by Google, some of the main reasons that influence Brazilian consumers to buy online are special offers, discounts, and promotions.

In addition, the most popular payment methods in Brazil – besides the traditional credit card – are boleto bancário, and Brazil’s latest success, Pix.

Boleto is a popular payment method in Brazil for consumers and businesses, issued in the form of a PDF file right at the time of purchase. Pix is the instant payment method developed by the Central Bank of Brazil that has boomed since its launch.

Both payment methods debit money from the buyer’s account as soon as the payment is completed – similar to a debit card purchase.

Read more: How Pix Has Influenced the Digital Payment Realm in Brazil

In other words, providing discounts for one of these payment alternatives will encourage buyers to pay for their purchase at once (instead of paying in installments using a credit card), and merchants won’t need to worry about credit card processing fees and anticipation fees for installments.

Reduce costs by offering discounts per payment method

While offering customers a more comprehensive range of payment methods, merchants can increase business profitability with significantly reduced costs.

Did you know that a credit card transaction can be about 20 times more expensive than a Pix transaction? This can mean up to 2% more profit on your total turnover!

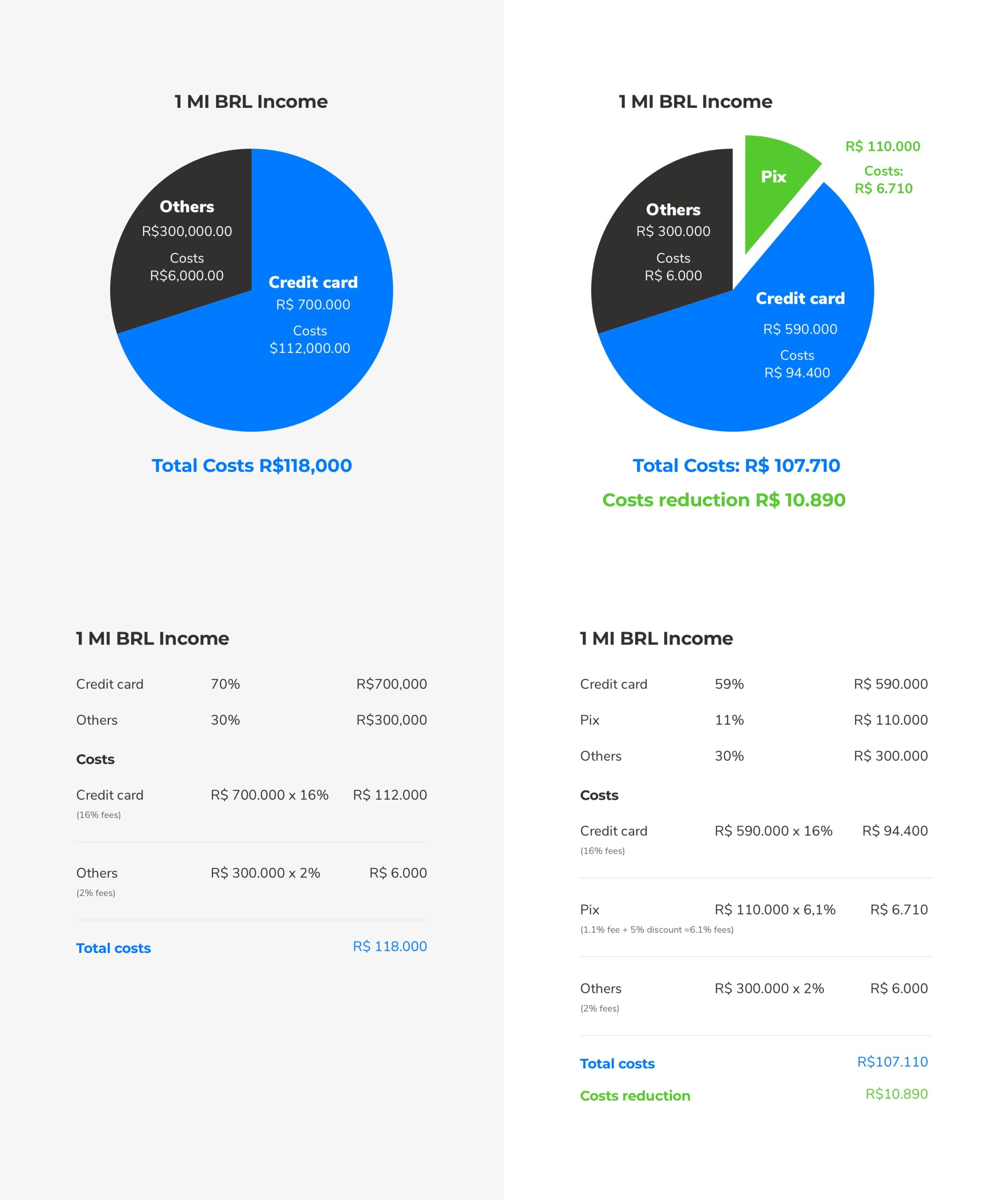

The example below is based on a digital shop model with a monthly turnover of R$ 1 million. On average, the shop receives payments in installments — in eight installments, to be more specific — on credit card purchases.

Scenario #1: Credit card sale

- The online shop sold some products on its ecommerce platform and made BRL 1 million;

- 70% of its revenue originates from credit card sales (eight installments, on average), which represents R$ 700,000.00;

- Credit card fees are around 16% (transaction fees + advance fee, taking into account the average of eight installments);

- Considering the credit card billing, in the end, the merchant paid R$ 112,000.00 in transaction and advance fees.

Scenario #2: Pix Sale offering 5% discount

- The merchant sold products earning the same R$ 1 million;

- And offered a 5% discount on payment with Pix;

- The Pix discount attracts some customers who would typically pay with a credit card, transferring 11% of their total billing to the instant payment method;

- In this scenario, with Pix, the merchant must discount Pix transaction fee (which is, on average, only 1.1%) + 5% of the discount applied to Pix and, in this case, there is no anticipation fee;

- The 11% of the value of the purchase in the store, migrated from credit card to Pix, represents a turnover of R$ 110,000.00;

- Transaction cost per Pix is 6.1% (1.1% fee + 5% discount) instead of 16% for credit card. This results in a savings of 9.9% on the share transferred from credit card to Pix;

- In other words, a cost reduction of R$ 10,890.00 (9.9%), represents 1.1% of total revenue

Discount on payment method with PagBrasil

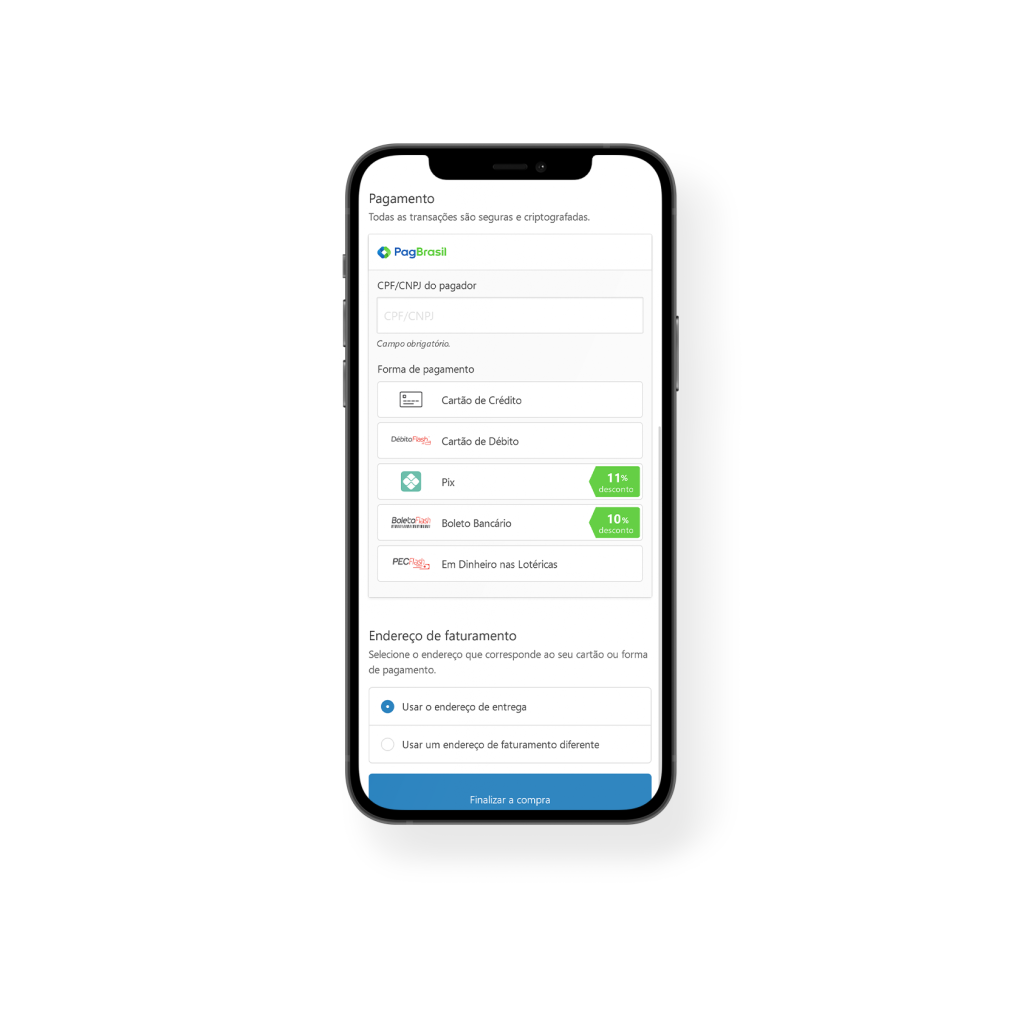

We offer discounts per payment method at our checkout. When they complete their purchase, customers will see the green tag near the payment method of their choice with the discount amount being offered.

Merchants can set up discounts using our Shopify app, payment link, or API integration. If you wish to activate the discount per payment method using one of the methods we’ve mentioned, please get in touch with your account manager at PagBrasil and specify the discount you want to set for each payment method. If your online store isn’t processing payments with PagBrasil yet, please get in touch with our team!