The success of online businesses is strongly connected to how easy they can make it for their consumers to find what they are looking for and pay for it. As with everything on the internet nowadays, the user experience must be a focal point for e-commerce merchants. When it comes to alternative payment methods available at the checkout, each market will have its needs and particularities.

In Brazil, there are 55 million unbanked adults. Furthermore, over 50% of Brazilian households have some type of debt such as installment purchases with credit cards, car leases, loans or insurance. Therefore, by offering alternative payment methods at their stores, merchants can open the e-commerce doors to people who otherwise would not have a way to purchase online.

The Main Alternative Payment Methods in Brazilian E-commerce

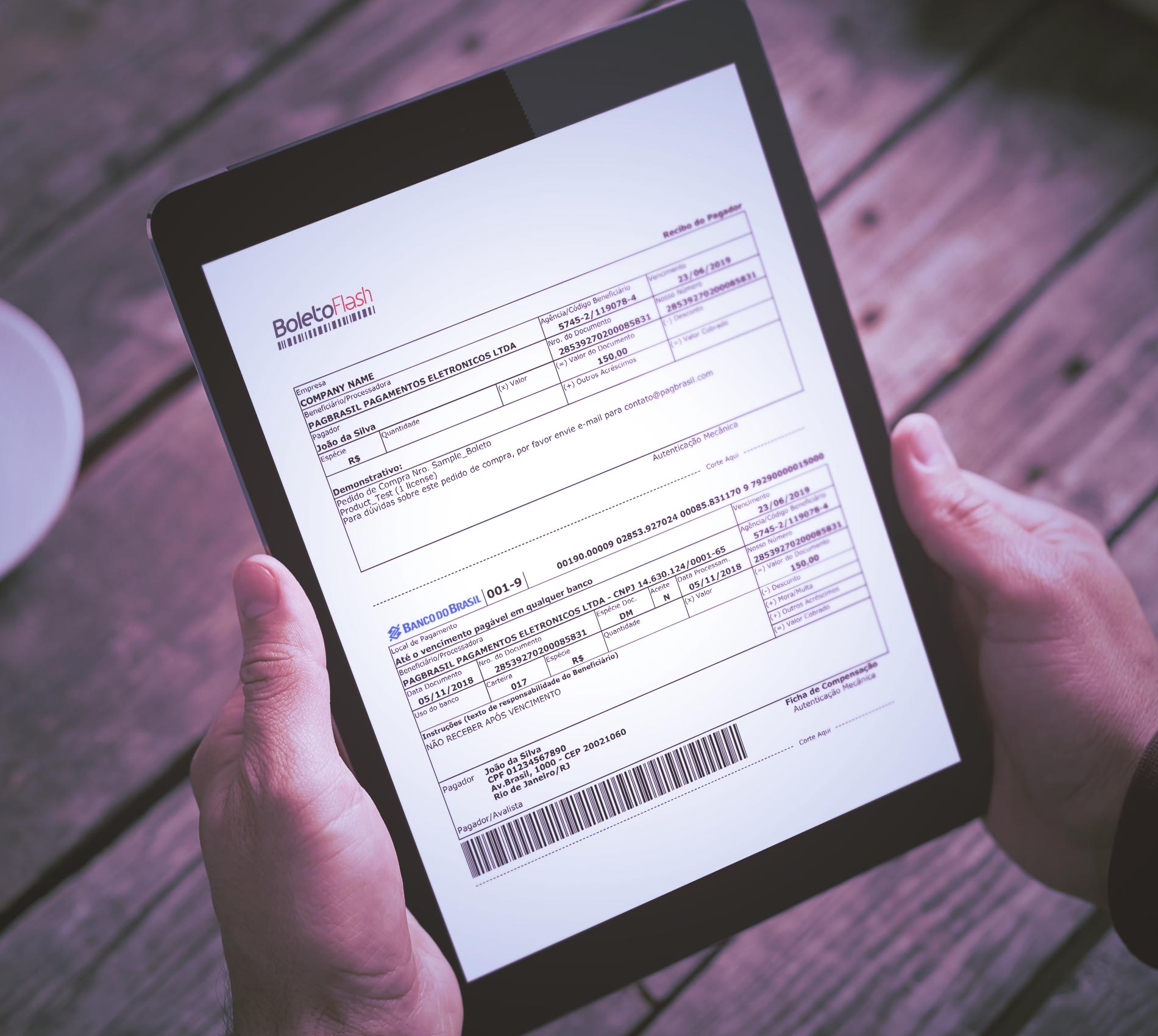

Boleto bancário, the second most used e-commerce payment option in Brazil, is by far the most popular alternative payment method in the country. Since its origins in the early 90´s, the boleto system has provided a democratic payment alternative, as it can be used by anyone, regardless of having a bank account or enough credit.

Febraban, the Brazilian Federation of Banks, estimates that 3.7 billion boletos are paid every year in the country, that is approximately 10 million per day. In the e-commerce segment, the payment method accounts for about 25% of all payment transactions. To bring the boleto system closer to the 21st century and the e-commerce needs, PagBrasil has created an improved version of the payment method, the Boleto Flash®. You can read more about this unique boleto, which includes a responsive technology and provides payment confirmation in under two hours, here.

Online banking transfer is another alternative payment method gaining share in the Brazilian e-commerce segment. Some of the major Brazilian banks have created their own proprietary online payment method, known as online banking transfer, which offers online shoppers the ease of paying via bank transfer with just a few clicks.

Why Are Alternative Payment Methods Important?

Be it by their own choice or not, a great number of Brazilian consumers will not use a credit card to pay for their online purchases. By making alternative payment methods available at the checkout, merchants will be improving these buyers’ experience on their website and, therefore, achieving better payment conversion rates.

Furthermore, alternative payment methods are a great solution to cover gaps in the market. The more Brazilian e-commerce evolves, the more solutions are created to facilitate e-commerce payment transactions and we should expect more disruptive solutions to be introduced in the years to come.