Three months have passed since the launch of Pix, the Central Bank of Brazil’s instant payment method. And in a short period of time, more than 65 million users – including 61.5 million individuals, aside from companies – have adopted the new payment method. In the first weeks of the year, the number of money transfers made with Pix reached 286 million, against 53.2 million TED operations.

Read also: Pix: numbers and next steps for the new payment method

Although Pix is mostly used for P2P – person to person – transactions, it is only a matter of time before users adopt the new payment method in ecommerce.

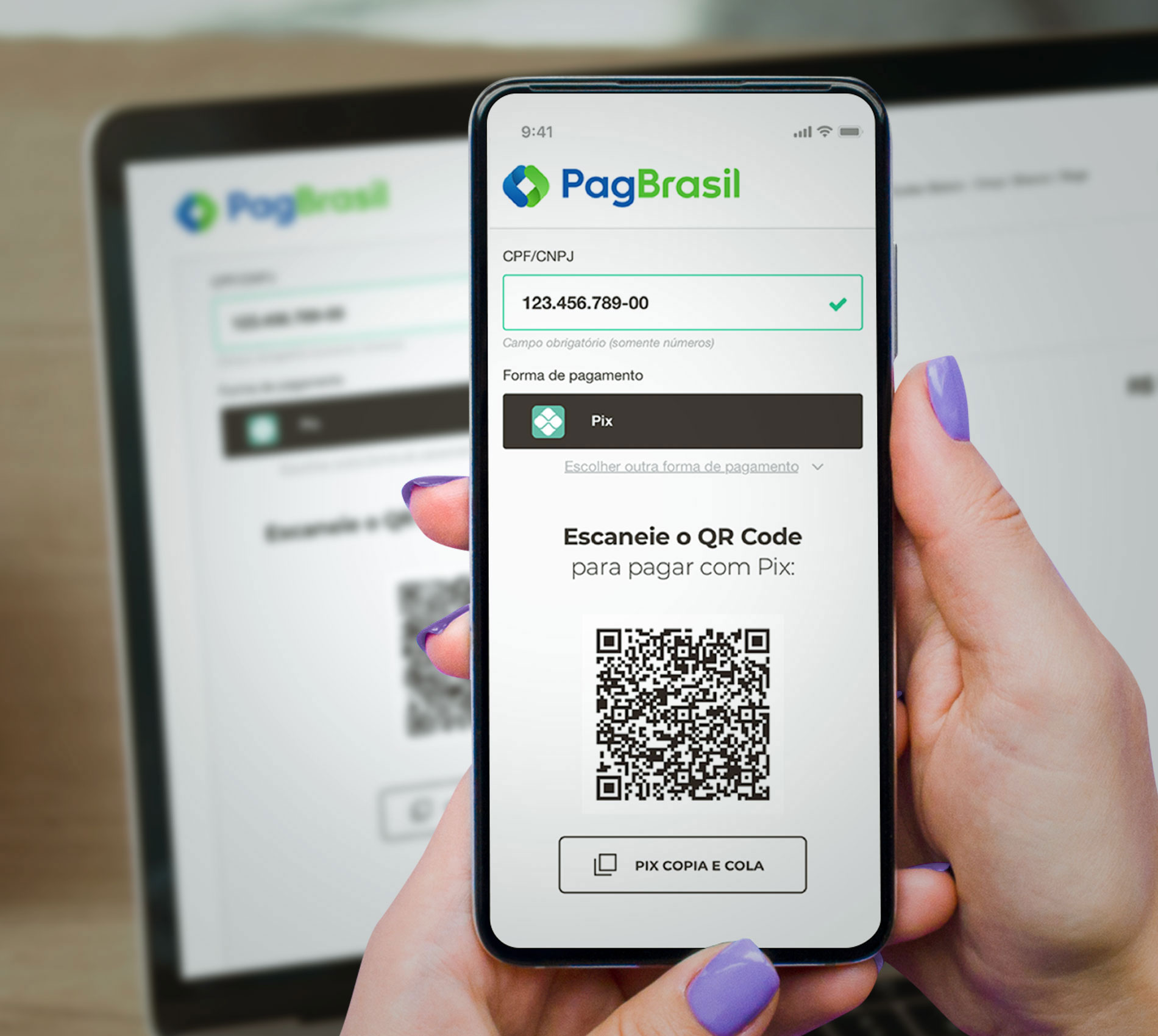

Simple and intuitive: how to pay with Pix in ecommerce

The more simplified the payment steps are at the checkout, the higher are the chances of completing a purchase. Therefore, merchants selling to Brazil that offer Pix in ecommerce can benefit from an increase in their conversions.

However, this can only happen if the payment steps with Pix at the checkout are easy and intuitive, making the purchase process more fluid. This is why PagBrasil Pix was designed to enable a better experience for the user. Check out how simple it is to pay with Pix!

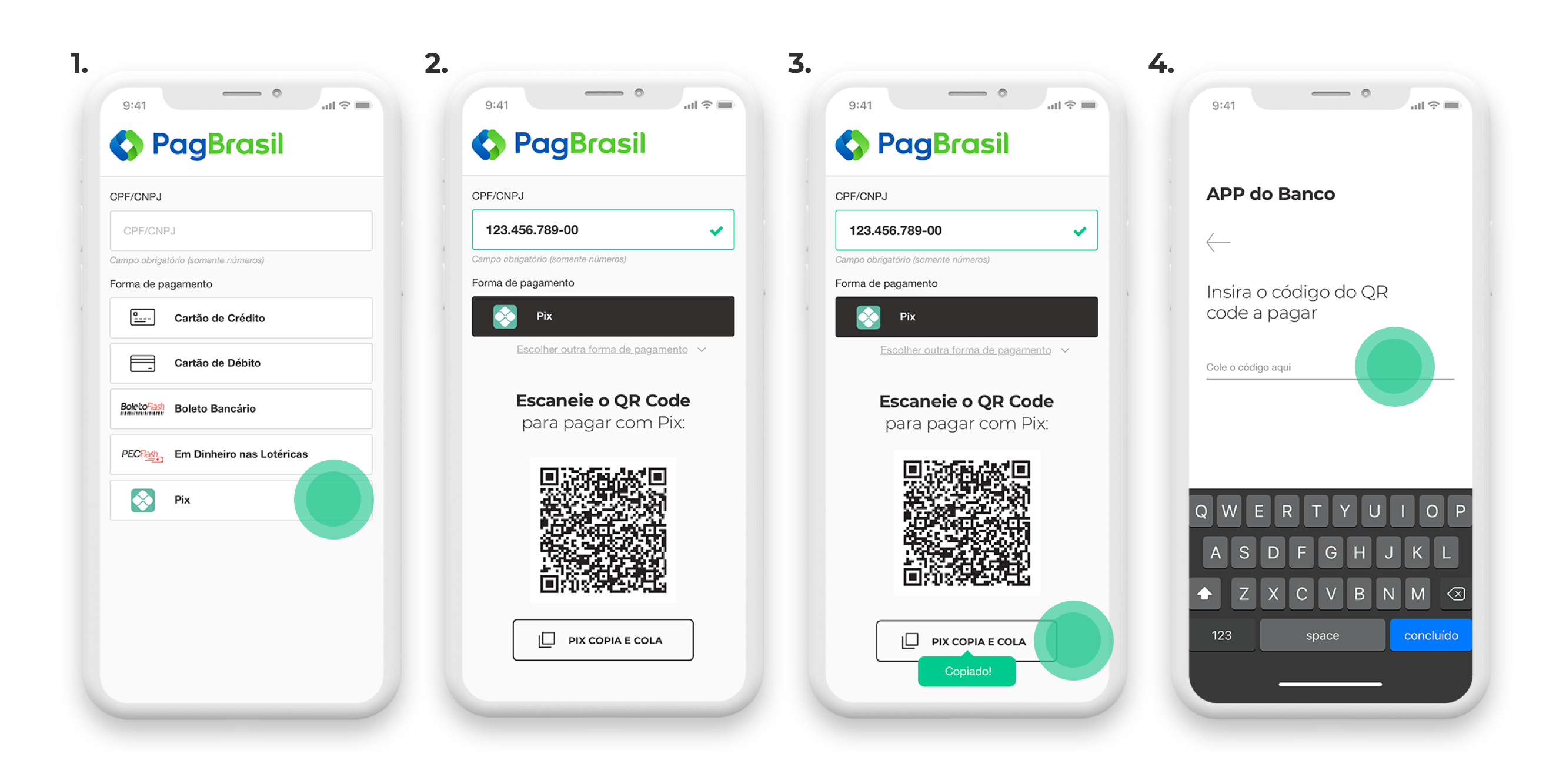

Step by step

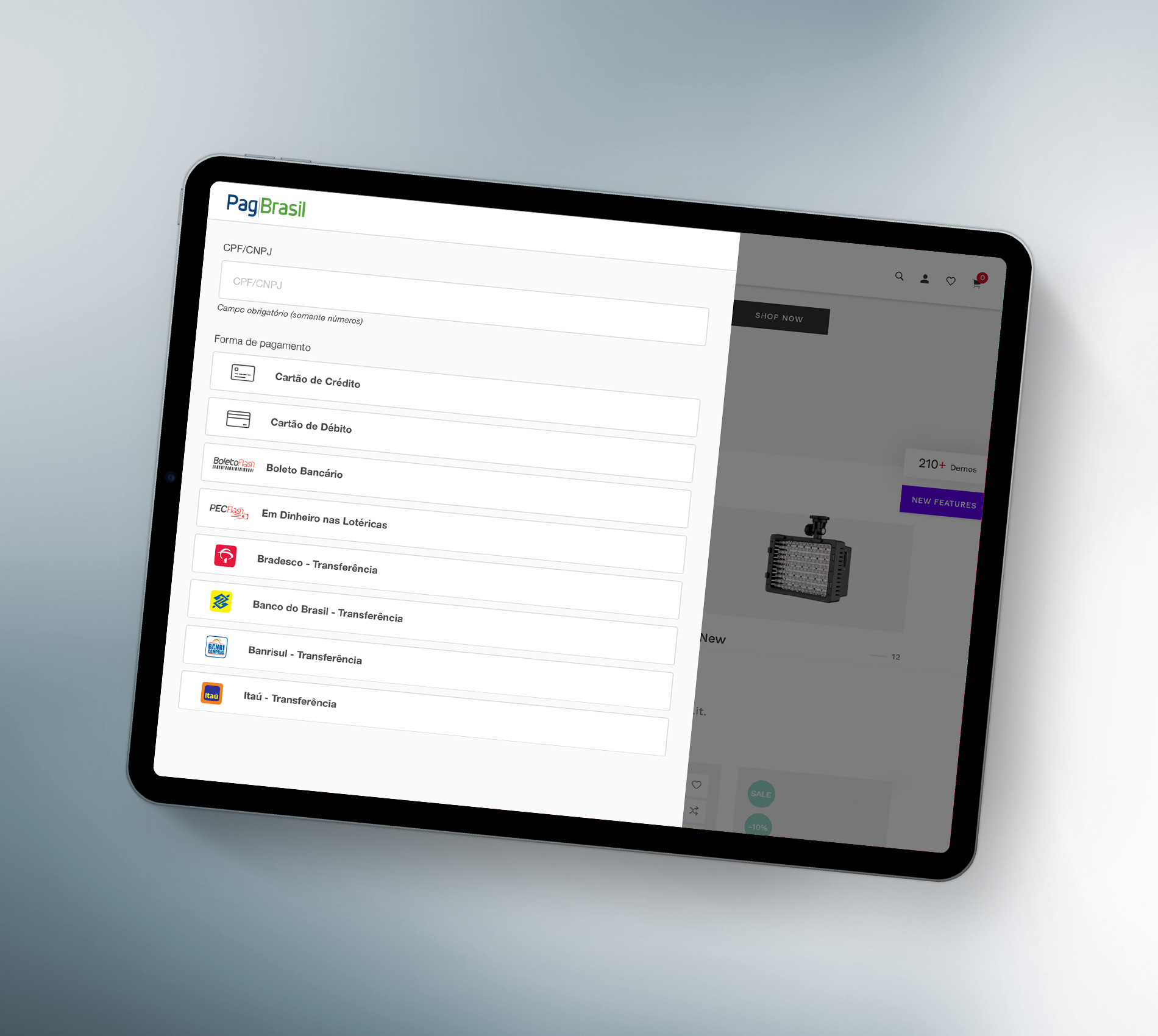

1. The user selects Pix at the checkout.

2. A QR code is displayed on the screen, along with a “Pix Copia e Cola” button.

3. The user clicks “Pix Copia e Cola” to copy the transaction’s code or scans the QR code using another smartphone.

4. The user opens the banking or digital wallet app, copies the code, and concludes the transaction!

Benefits of PagBrasil Pix for ecommerce businesses in Brazil

Thanks to the payment method’s agile and simple nature, PagBrasil Pix offers a number of benefits for both consumers and merchants.

• Encourages impulse purchases: with Pix, the consumer can quickly complete the purchase, encouraging impulse shopping.

• Accelerates the delivery process: since the payment is confirmed in an instant, the product can be quickly released for delivery.

• Allows the service to be immediately made available: the same way Pix accelerates the delivery process, the payment method also allows services or digital products to be immediately made available to the customer.

• Doesn’t retain stock: merchants can set the expiration limit of the Pix generated on the checkout, avoiding stock retention in case the customer doesn’t complete the payment.

Want to learn more about PagBrasil Pix? Get in touch with our team through our website for more information!