E-commerce is rising in Brazil, and to keep up with the market trends, there are complete payment solutions with a fluid checkout made available by PagBrasil to help you increase your sales and conversion rates.

You have a physical store that sells exclusive products and has a select audience. Movement is low in your store, so you decide to use your brand’s institutional website to include some products and sell them online – an alternative to increasing your sales.

To do this, you embed in your online shop the WooCommerce plugin – the most popular e-commerce plugin at WordPress, with more than 3.5 million users. This plugin lets you register your products and start sales immediately in an easy way.

Read more: PagBrasil’s cutting-edge WooCommerce plugin for payments in Brazil

“And now, how can I maximize my sales?”

Now that you have the online store to handle items sitting in stock at your physical store, you need to choose a secure payment processor that offers an effective checkout.

In this manner, your customers will enjoy an easy purchase journey without friction, and, consequently, you will be able to maintain great conversion rates.

Boost your conversion rates with PagBrasil WooCommerce Solution

E-commerce in Brazil is expected to increase yearly. According to a study conducted by Worldpay from FIS, a global leader in financial technology, it is set to grow 56% by 2024.

Read more: Brazil in 2022 – An Overview of the Market

If you wish to take a share of the market, partnering up with the right strategic partner in Brazil is crucial to success. PagBrasil offers the best solutions in this realm. We’ve listed some of the benefits a cross-border merchant can have from such collaboration.

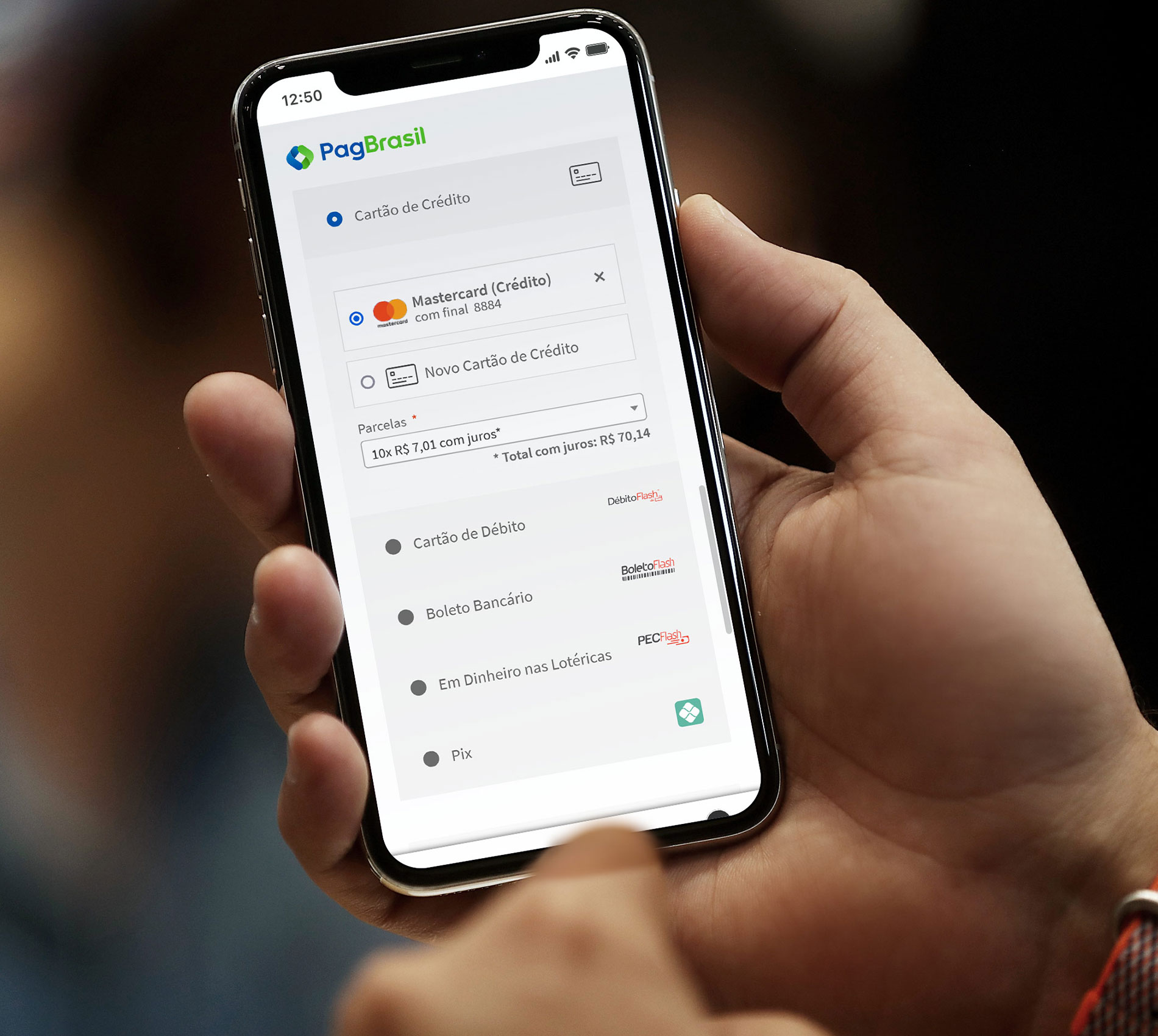

- The broadest set of payment methods in Brazil

The PagBrasil WooCommerce plugin offers the most comprehensive set of local payment methods in Brazil, including Débito Flash®, PagBrasil Pix, Boleto Flash® and PEC Flash®.

- Compatible with PagStream®

PagStream® is a complete subscription service in Brazil that supports any monetization strategy and is perfectly adaptable for business models that work with recurring payments.

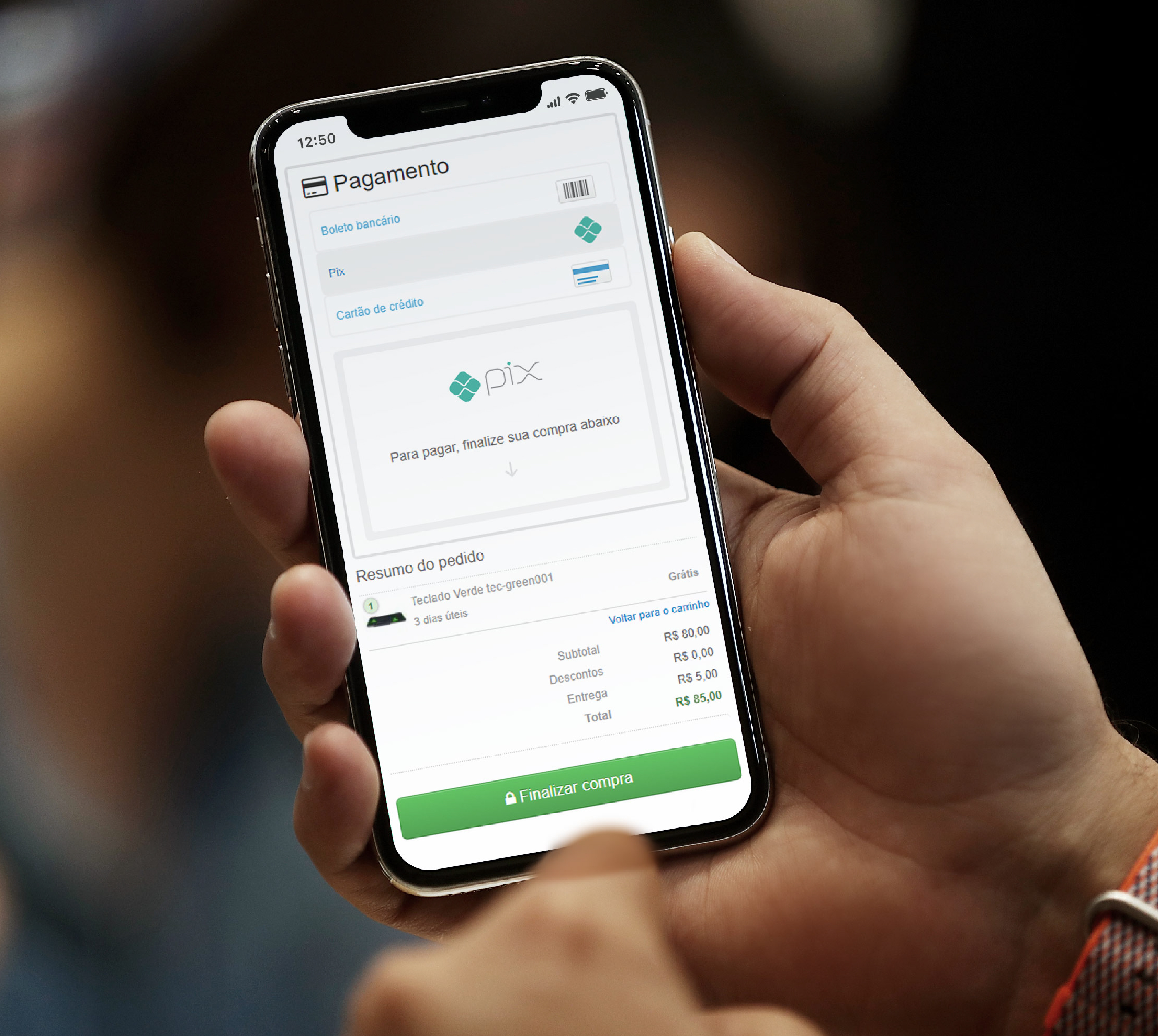

- Direct checkout with optimized payment flow

Impulsive shopping represents 44% of online purchases in Brazil, according to the National Federation of Store Managers (Confederação Nacional de Dirigentes Lojistas) and SPC Brasil.

Read more: How to Optimize Your Checkout for Online Payments in Brazil

Buyers can complete their purchase within the merchant’s domain, using the payment method of their choice. PagBrasil streamlines the checkout process, offering a safe, credible, and transparent payment flow with no redirection to an external URL.

- Mobile-friendly

Brazilians lead the global ranking on average hours spent on mobile per day, with 5.4 hours daily, so your online shop needs to be mobile-friendly.

PagBrasil’s payment solutions are designed to adapt to smartphone screens, regardless of the payment method.

- Payment Link

Recover abandoned carts with a payment link and offer your customer a second chance to buy your product. Instead of simply sending an email inviting the consumer to return to the store and complete the purchase, you can send a payment link and thus further enhance your remarketing actions.

Read more: PagBrasil launches new solutions with Pix: recurring payments and payment link

- 1-click Payment

This function allows the customer to securely save credit card information and make a fast, frictionless payment for future purchases.

- CPF/CNPJ Validation

This feature indicates whether the number entered in the checkout field is valid, avoiding possible errors in issuing registered bank slips. In addition, it also helps in fraud prevention because if the CPF or CNPJ is wrong, the system can recognize this and reject the sale.

- State-of-the-art antifraud solution

Automatically identify fraudulent transactions with PagShield®, PagBrasil’s state-of-the-art anti-fraud solution designed explicitly for the particularities of the Brazilian e-commerce market. Discover all the advantages of our Woocommerce plugin and contact us to learn more!