The boleto bancário is one of the most popular payment methods among Brazilian consumers, representing nearly 20% of the national preference when shopping online, according to Ebit|Nielsen. In a country where 71% of the population still prefers to pay with cash, and where access to credit card is limited, this payment method plays an important role in digital shopping inclusion. While many cross-border ecommerce businesses are well aware of this scenario, B2B companies might not realize how important this payment method is for companies in Brazil as well.

Recommended: What is boleto bancário?

As explained above, access to credit is limited in Brazil, and this also extends to companies. According to Serasa Experian, there are 5.4 million companies in Brazil in debt. The total debt value is BRL 124.1 billion, which makes an average of BRL 23,000 per company. This is a reflection of the country’s recession, that has affected 61.7 million Brazilians according to the Serviço de Proteção de Crédito (SPC Brasil) and Confederação Nacional de Dirigentes Lojistas (CNDL). That said, it is nearly impossible for companies in Brazil to rely only on international corporate credit cards.

But even companies with financial stability use the boleto bancário to pay for their expenses. This payment method is widespread in Brazil and is a part of the regular accounting routines of businesses of all sizes.

Why do Brazilian companies use the boleto bancário to complete their payments?

The main reason companies prefer the boleto bancário is cost. Businesses usually offer 5%-10% discounts to incentivize purchases with the boleto bancário, as this lowers their costs with installment payments – a popular payment practice where the customer, using a credit card, may divide the total cost of the purchase into a set of monthly payments.

Each installment may have 1-5% of interest added, which increases the merchant’s cost. With the boleto bancário, not only do merchants have lower processing costs applied to the sale, but clients are offered a more suitable payment solution. Besides, international purchases completed with credit cards have a local tax called IOF (Imposto sobre Operações Financeiras) applied to them, increasing the cost by 6.38%.

What drives B2B cross-border ecommerce sales in Brazil?

If access to corporate international credit cards is so difficult, why do companies in Brazil purchase from cross-border e-commerce businesses?

There are a few reasons that drive companies to purchase products and supplies from online stores abroad. The fast delivery process is one to account for: some suppliers in Brazil may take as much time to deliver a purchase as cross-border businesses.

Price is another important element, even with the exchange rate and import taxes. Certain industries benefit from lower prices when purchasing cross-border because there are few (or no) local manufactures, which reduces competition and also raises prices.

At last, flexibility is another element that helps drive cross-border sales in Brazil, since this allows local businesses to choose suppliers from all over the world. This makes it possible to order smaller volumes – as opposed to orders from China, for instance, which may require higher volumes and take longer to deliver.

How do B2B companies selling to Brazil benefit from the boleto bancário?

If you have come this far, you are now well aware of the advantages that the boleto bancário offers Brazilian companies. But how does this payment method benefit cross-border e-commerce businesses?

Increases sales

Because the boleto bancário is a popular payment method in Brazil, your business will ultimately reach several companies that do not work with international credit cards. In addition, the sales volume also increases as companies can purchase with higher frequency, since there are no restrictions tied to credit card usage – such as compromised limit, for instance.

Reduces chargeback risk

Brazil is one of the leading countries when it comes to online fraud, which means chargeback rates are very high. Also, requesting a chargeback is relatively easy when compared to other countries, and merchants don’t often win disputes due to the strong consumer protection legislation in the country.

Recommended: Why Does It Seem So Easy to File a Chargeback in Brazil?

When offering the boleto bancário, e-commerce businesses reduce the risk of chargeback and avoid penalties from acquirers.

Recovers abandoned cart

The boleto bancário can be used to recover customers who abandon the shopping cart before completing the payment. With an adapted checkout and automated generation, the boleto is sent to the customer, creating a second conversion opportunity.

Recommended: Abandoned Cart Recovery with Boleto

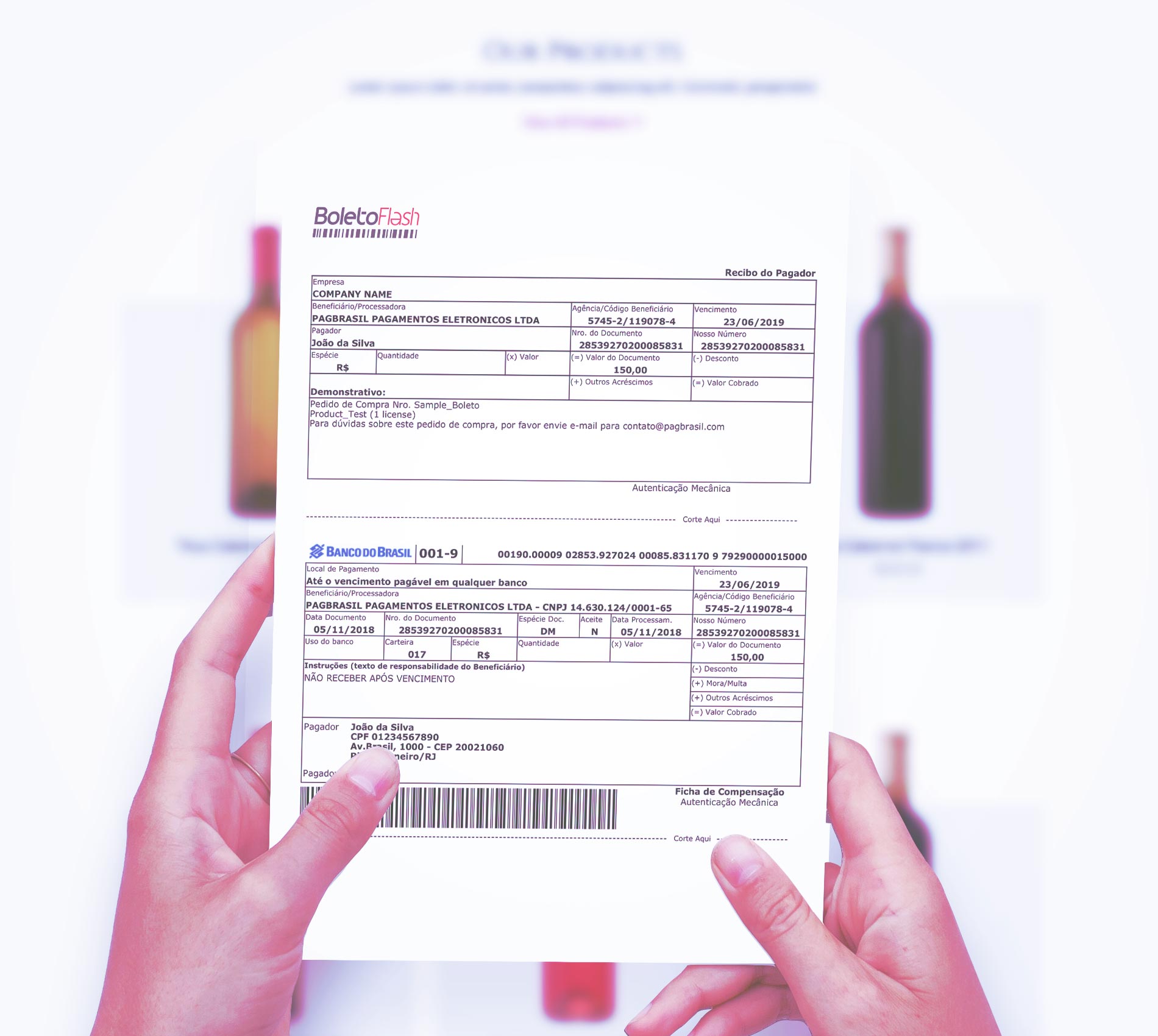

Meet Boleto Flash®, the fastest boleto in the market

To meet the needs of Brazilian e-commerce consumers, PagBrasil has developed the exclusive Boleto Flash®: the only boleto on the market with payment confirmation in less than one hour.

Traditional boletos usually confirm payments in 1-4 business days. In addition, the payment is usually set to expire within 1-15 days, and, in the meantime, the product is retained until the customer completes the payment. With Boleto Flash®, merchants may set the payment due date for the same day as the order is placed, avoiding stock retention. Learn more about the benefits of Boleto Flash® at www.boletoflash.com

Comment

Hello,

I wish to know whether boleto support web business like domain industry etc and if yes which are the the providera