Black Friday has become a global phenomenon, driving sales for both physical and online businesses. The date, celebrated in Brazil since 2010, is marked by deals and promotions and attracts millions of consumers in search of the best prices. However, in the digital environment, behind the euphoria of shopping, a growing threat lurks: fraud against retailers. Every year, criminals improve their tactics, aiming to profit from system vulnerabilities and consumer haste, harming retailers and customers alike.

On the other hand, fraud prevention systems are becoming increasingly sophisticated, and campaigns by card issuers about scams are helping to curb criminal activity. A report by Konduto showed that from 2022 to 2023, there was a 1.7% drop in fraud attempts during the month of November.

In this article, we will explore the main types of fraud against retailers on Black Friday and how to protect yourself, in addition to guiding consumers on best practices to avoid falling victim to scams.

What are the main types of card fraud during Black Friday?

In 2023, of the approximately 280 million credit card purchase orders in e-commerce, 3.7 million were fraud attempts. Despite corresponding to only 1.4% of total transactions, this amount of fraud represents R$3.5 billion, according to the 2023 Fraud Map.

There are several types of credit card fraud carried out by criminals, victimizing both retailers and consumers. Below, you can check out some of them:

Card not present: This occurs when a transaction is made using credit card data without the need for the physical presence of the card or the cardholder. Card data can be obtained in a variety of ways, such as through discarded receipts, database attacks, or phishing. This type of fraud is common in online and phone purchases, and usually goes unnoticed by the cardholder until they check their bank statement.

Friendly fraud: This occurs when a credit card holder makes a legitimate purchase but later requests a chargeback without just cause. This practice can be intentional, similar to shoplifting in a physical store, or accidental, due to an error or lack of recognition of the purchase.

Card tester fraud: The main objective of card tester fraud is not to acquire the product or service, but to verify if stolen credit card details are valid. The fraudster uses an e-commerce payment system to test this information, which is usually obtained from illegal lists sold on the Dark Web, phishing, or spyware.

True fraud: Also known as identity theft, this is characterized by the theft of someone’s personal information and the subsequent use of this data to obtain financial benefits. Fraudsters can obtain data such as ID numbers, social security numbers (CPF), dates of birth, and bank account and credit card details. They then use the stolen data to carry out fraudulent transactions by assuming the victim’s identity. The fraudster can open various accounts and lines of credit using the victim’s name.

How can e-commerce retailers protect themselves from fraud?

Scammers are everywhere and use different techniques. But what can retailers do to protect themselves?

Anti-fraud solutions are like a shield for your e-commerce, protecting it against financial fraud. They use advanced technologies, such as artificial intelligence and machine learning, to analyze a large volume of data and identify suspicious behavior patterns.

Types of anti-fraud solutions:

- Risk analysis with machine learning: Artificial intelligence and machine learning allow anti-fraud systems to identify complex fraud patterns by analyzing historical and real-time data, such as buying habits, geographic location, and devices used. This technology is able to learn from new information and adapt to new threats.

- Registration data verification: Verification of data such as CPF (social security number), CNPJ (company registration number), address, and other details is essential to validate the buyer’s identity and prevent fraud such as the opening of fake accounts. This step is crucial to ensure the security of transactions.

- User behavior analysis: Analysis of user behavior, such as purchase frequency, average transaction value, and devices used, allows for the identification of atypical behaviors that may indicate fraud. This analysis is performed in real time, allowing for the detection of fraud before it causes damage.

- Device verification: Device verification allows you to identify if the device used to carry out a transaction is reliable or if it has been used in other fraudulent transactions.

Essential functionalities of an anti-fraud system:

A good anti-fraud system should offer the following functionalities:

- Real-time detection: The ability to analyze transactions in real time is critical to blocking fraud before a transaction is completed, minimizing losses for the business.

- Integrations with payment gateways: Integration with different payment gateways facilitates data collection and analysis, optimizing the fraud detection process.

- Manual risk analysis: The possibility of configuring custom rules and performing manual analyses allows for complementing automatic detection, especially in more complex cases.

Benefits of implementing an anti-fraud system:

Now that you have discovered the essential functionalities, check out the main benefits:

- Chargeback reduction: By reducing the number of frauds, companies reduce the number of chargebacks, which contributes to maintaining the financial health of the company.

- Increased approval rates for legitimate sales: By reducing the number of false positives, anti-fraud systems allow for the approval of a greater number of credit card transactions, increasing the sales conversion rate.

- Protecting the company’s reputation: Fraud prevention protects the company’s reputation, increasing trust among customers and partners.

- Saving time and resources: By automating fraud detection, companies optimize team time.

Meet PagShield®, PagBrasil’s anti-fraud solution

As we saw above, having a good anti-fraud system is essential to protect your e-commerce, especially during periods like Black Friday.

PagShield® is PagBrasil’s own anti-fraud solution and offers the technology your business needs to combine the best of both worlds: reducing chargebacks and maximizing credit card approvals.

PagShield®‘s intelligent learning and purchase behavior analysis technology reduces your e-commerce chargeback rate by up to 88%. And it does so without compromising the credit card approval rate, which can reach 99%.

Artificial intelligence and machine learning enable the identification of complex fraud patterns by analyzing historical and real-time data, from purchase behavior on a website and on other e-commerce platforms, understanding buying habits, geographic location, and devices used. The technology is capable of learning from new information and adapting to new threats.

PagShield® uses Konduto’s database to perform analyses. Konduto is a world pioneer in the use of machine learning and browsing behavior monitoring technologies to combat online fraud.

How PagShield® works

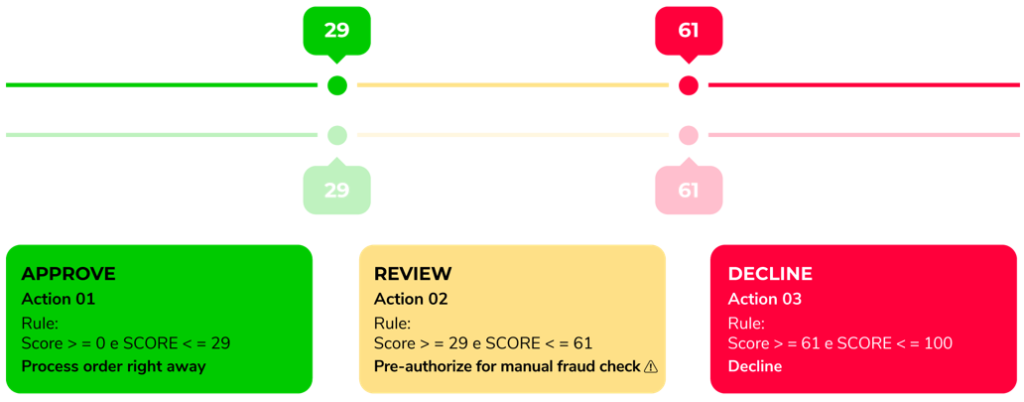

Based on an order’s score, PagShield® approves, pre-authorizes, or rejects the order.

Check out the example:

The retailer has the autonomy to customize the anti-fraud slider according to the risk level of their operation, and can always count on the support of our fraud prevention team for the best market practices for their segment.

Orders with medium risk fall under pre-authorization, and, so that the retailer does not lose any legitimate orders, we add an extra layer, which is human analysis.

We provide training and a detailed guide with step-by-step instructions and insights to analyze pre-authorized orders.

In the video below, you can see a chat between PagBrasil’s CEO, Ralf Germer; Juliana Duarte, the CEO of SetYou, a company that uses PagShield®; and Patrick Scripilliti, Digital Commerce Expert at TOTVS. The video is in Brazilian Portuguese, but you can enable closed captions for subtitles in your preferred language.

And it’s worth remembering that your e-commerce payment processing company must comply with security standards.

PagBrasil’s PCI DSS Level 1 certification attests to its commitment to security and compliance with PCI requirements. Our platform has the highest security standard available in the payments industry and offers total protection for your business transactions.

The certification describes essential practices for companies to keep their systems and environments secure against consumer card data theft, in addition to detecting, mitigating, and preventing cyberattacks and failures.

Security tips for consumers

It is not only retailers who need to protect themselves from fraud; after all, it also affects the end consumer, who can have their data stolen for fraudulent purchases.

Therefore, it is also up to consumers to have protection strategies, such as using a password manager and virtual cards.

Password managers are programs that store passwords securely and in encrypted form. Instead of creating weak passwords and reusing them on various websites, a consumer can create complex and unique passwords for each account. The manager takes care of remembering them all, and the user only needs to remember one master password to access the program.

A virtual card is a temporary credit card number generated by the user’s bank. When making an online purchase, the consumer uses this number instead of their main card number. If this virtual card is compromised, only the specific transaction will be at risk.

You can create educational content that guides your consumers on these security practices. This gives more credibility to your store and can reduce the incidence of fraud.

And if you have an e-commerce business but want to optimize your results with a robust anti-fraud system, be sure to talk to our experts. Together, we will understand the specifics of your business and maximize your results.