Last update: 28/03/2022

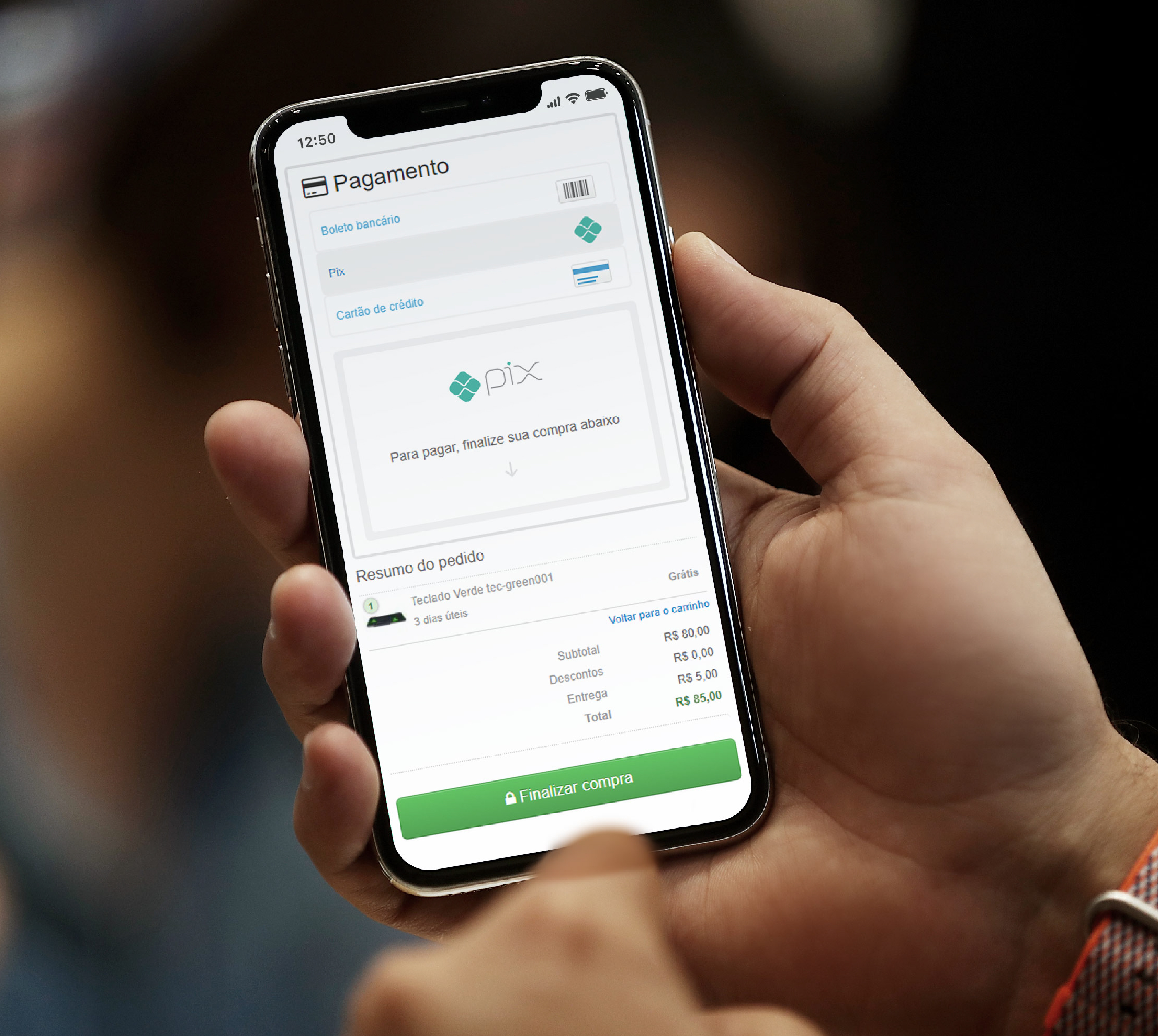

Boleto bancário is still one of the most used payment methods in Brazil. despite the rise of Pix, Brazil’s instant payment method launched in November 2020, boleto is still one of Brazil’s favorite payment alternatives.

When it comes to shopping in international e-commerce, Boleto is the number one choice, says a recent study.

Pix is still on the rise and it’s set to increase in the next few years, especially in national transfers and payments. Until it’s not made available for international transactions, the cross-border merchant can still count on boleto bancário to boost their sales in Brazil, even those offering their products or services on a subscription basis.

Read more: From Streaming to SaaS: Why Subscription Payment Model is Set to Skyrocket in Brazil

However, offering recurring payments with boleto can seem problematic for many online merchants. The main reason for that is that the popular Brazilian payment method requires an action on the users’ side to complete the payment.

Nonetheless, Brazilian consumers are not only used to paying for services such as gym subscriptions, magazines/newspapers subscriptions and school/university tuition on a recurring basis with boleto, but they expect to have the option to choose boleto as a payment method for many subscription-based services.

Why Offer Recurring Payments with Boleto?

There are several reasons why merchants should consider offering recurring payments with boleto on their online stores. Below, we list some of them:

- Easier access to B2B clients: online businesses focusing on the B2B segment must have this option if they want to succeed. Although recurring payments with credit cards are popular among natural persons, enterprises often require paying by boleto. This happens because corporate credit cards are not very popular in Brazil and many companies require approval for the purchase or worry about false charges. In addition, boletos facilitate businesses’ accounting. Both businesses and natural persons prefer paying via boleto not to compromise their monthly credit limit with fixed expenses. If every subscription service carries out recurring billing via credit card, they will see their credit consumed with fixed expenses.

- Access to unbanked consumers: 34 million adults in Brazil don’t have a bank account. For these consumers, boleto is the only alternative to purchasing online. By offering recurring payments with boleto, merchants can expand their audience and increase their sales.

- Cashflow: Brazilian acquirers carry out the payouts after 31 days of credit card payments and charge high fees for anticipating the funds. Payment processing services might have different settlement options, but there are generally costs for anticipation. On the other hand, as the money from boleto payments is usually available within 2 to 3 business days from the payment date, merchants with a certain transaction volume can benefit from better cash flow without paying anticipation fees.

- Lower processing fees: Compared to credit cards, boletos have better processing fees. This can help merchants increase their profit margin.

Read more: How to Avoid “Subscription Fatigue” and Boost Subscribers’ Loyalty

Automatizing Recurring Payments with Boleto

A significant advantage of recurring payments with credit cards is the possibility of having the entire process automatized. Even though the customer cannot be automatically charged via boleto, it is possible to automate the process of generating and sending the boleto to the consumers periodically. Such automation is essential to an effective strategy of recurring payments with boleto.

If a customer doesn’t want to pay with a credit card right away, offering as many payment alternatives as possible increases engagement with consumers. When choosing Boleto Flash®, buyers will receive a monthly email listing all payment options available to migrate to another payment alternative whenever they are ready.

Read more: Brazil Among the Main Digital-first Consumers in the World

PagStream® is PagBrasil’s subscription management tool perfectly adaptable for business models that work with recurring payments. Easy-to-set, with no complicated integration, it supports all popular payment methods in Brazil, including PagBrasil’s exclusive Boleto Flash®, Pix, and PEC Flash®. With PagStream®, your business can maximize customer retention and sales. If you wish to learn more about this payment solution, get in touch with our team!