2021 was great for us at PagBrasil. This year, we fully embraced the four pillars that are part of our mission as a payment solution provider – offering innovation, integration, inclusion, and inspiration, also known as PagBrasil’s four I’s. This is reflected in every step we took throughout 2021, including launches, integrations, solutions, partnerships, products, and services.

To celebrate the fantastic work we’ve done this year, we’ve wrapped up our best numbers, data, and launches as a 2021 retrospective.

PagBrasil Pix: An Instant Success

Pix came as a successful instant payment method within the Brazilian market and could be considered the highlight in Brazil this year. Last November, Pix celebrated its first anniversary with an award by the Fintech & Regtech Global Awards. It has reached over 100 million users in less than a year due to its enormous success.

At the end of 2020, we launched PagBrasil Pix for digital businesses in Brazil and merchants with online stores selling in the country who wanted to reap the benefits that Pix has brought to national e-commerce.

For instance, we’ve seen rates reach nearly 80% among merchants that offered PagBrasil Pix as a payment option to their customers, beating traditional payment options such as credit cards and debit cards.

Read more: Pix 2022: What to Expect from Brazil’s Newest Payment Method

Pix for Shopify

Shopify is PagBrasil’s long-time partner. The two tech giants first partnered up in 2015 to provide a seamless and direct payment experience for the final customer. After six successful years working together, PagBrasil was the first payment processor to offer Pix for Shopify in its direct checkout. In the first trimester, PagBrasil Pix’s conversion struck 61%, and in the last months of 2021, conversions hit nearly 80%

Boleto Flash® and Pix on the Rise (and Combined!)

Boleto bancário is one of the most traditional payment methods – it is the second payment option most used by Brazilian shoppers. Our exclusive Boleto Flash®, the only boleto in the market with instant payment confirmation, and Pix are now combined.

A successful case using Boleto Flash® with Pix was with the Russian payment service giant, Xsolla, that focuses on gaming niches and its known for major gaming entities like Valve, Twitch, Ubisoft, and Epic Games.

Xsolla is the world’s leading video game commerce company, and they registered a spike in their payment conversion rates when PagBrasil launched the option to “Pay with Pix” embedded in the Boleto Flash®, in the second semester of 2021. In August, their conversion rates were 65%, and they rose to 76% in December.

Read more: Advantages of Switching Boleto Processing to PagBrasil

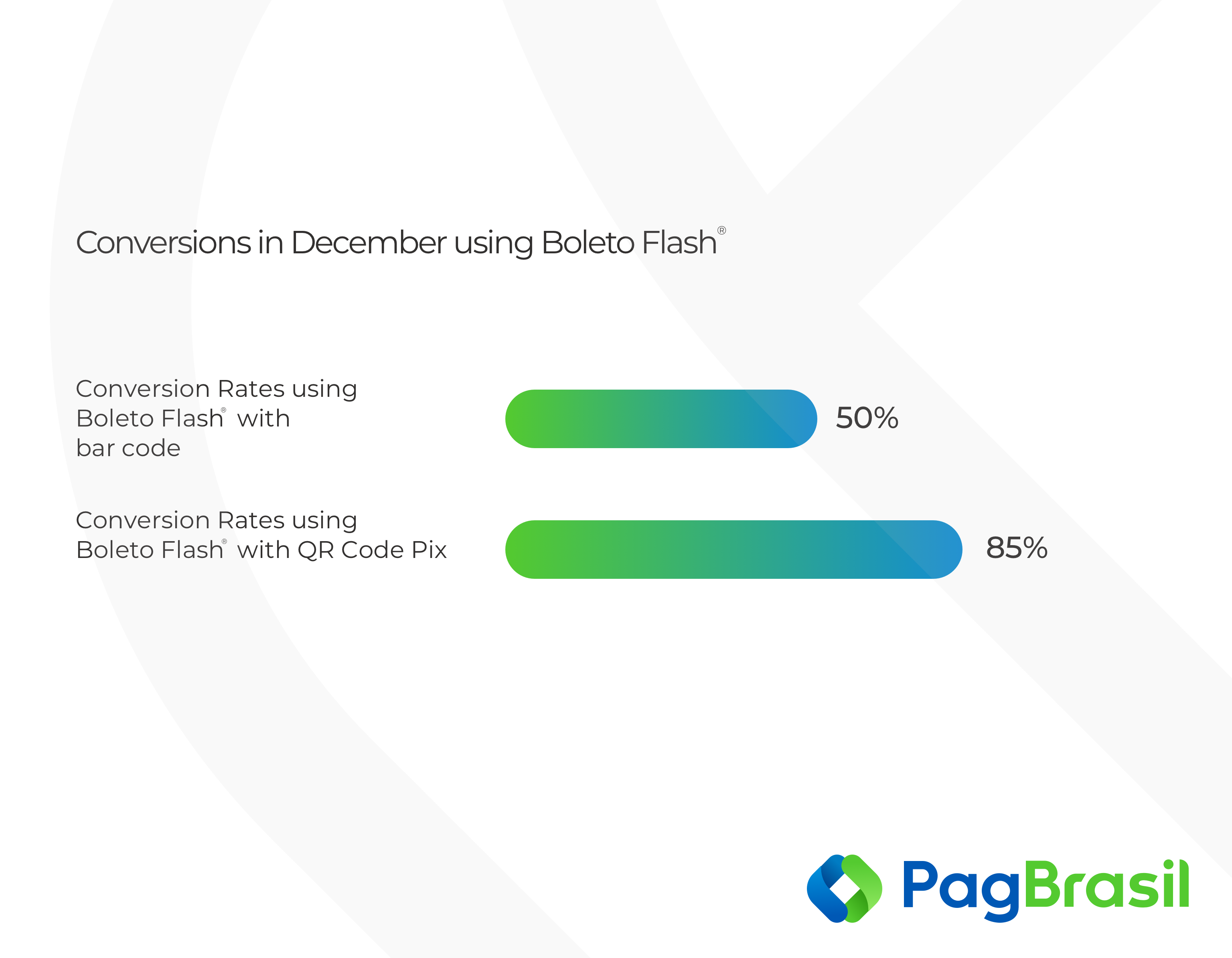

Comparing the conversion rates between Boleto Flash® paid conventionally with the barcode and the conversion numbers when the Boleto Flash® is paid using Pix, the difference is even more expressive — from nearly 50% in the conventional way to 85% with Pix — an outstanding 70% increase!

Read more: Advantages of Switching Boleto Processing to PagBrasil

Débito Flash™ has Revolutionized Debit Card Usage

To boost conversion using debit cards in Brazilian e-commerce – which currently represents the small chunk of 13% of the digital payments in the country, despite the massive 160 million active debit cards – in September this year, PagBrasil launched Débito Flash™.

This payment method enables nearly 80% of mobile shoppers in the country to shop without hassle. Traditionally, online payment using debit cards sends the buyer to another URL or requires them to follow a security protocol and doesn’t allow mobile transactions. With Débito Flash™, the entire process is completed within the merchant’s checkout page, with no need to redirect to another URL or app.

Read more: PagBrasil launches Débito Flash™ and revolutionizes debit card usage in Brazilian e-commerce

Payment Link

Online purchases through social media and instant message apps are huge in Brazil. PagBrasil also allows merchants to take orders through a payment link. As easy as it may sound, the merchant just needs to send out the payment link via message or email to the customer, and they will be redirected to a secure payment page and can select their preferred payment method to complete the purchase. The payment link offered by PagBrasil is one of the most complete in the market, as it embeds a wide range of payment options, like Boleto Flash®, PagBrasil Pix, Débito Flash™, PEC Flash® and credit cards.

With the payment link, there’s no due date, no invoice to bill, or if the buyer changes their minds about their purchase, the merchant doesn’t need to pay any fee. Because it’s so easy to use, payment links are considered one of the payment trends in 2022.

Read more: PagBrasil launches new solutions with Pix: recurring payments and payment link

PagBrasil’s Cutting-edge WooCommerce Plugin

In October, we launched a revamped version of the WooCommerce plugin, offering exclusive features with the broadest range of local payment methods, including local credit cards, PagBrasil Pix, Débito Flash™, Boleto Flash®, and PEC Flash®.

Besides opening up the opportunity to increase the consumer base with more payment options, the latest plugin version allows merchants to offer recurring payments with PagStream®, PagBrasil’s subscription management solution, and all payment methods provided by PagBrasil.

Read more: Recurring payments: 5 tips for efficient subscription management in Brazil

VTEX Plugin Gets a Boost

Last month, the VTEX plugin received an update that benefits merchants using PagBrasil’s payment solutions. The upgrade was created to offer as many options as possible for consumers in Brazil, such as providing installment payments with local credit cards, 1-click payments, recurring payments, subscription management with PagStream®, a complete payment link solution, and exclusive methods such as Boleto Flash® and PagBrasil Pix.

Despite the pandemic that shook Brazil and the world’s economy, e-commerce and digital businesses turned sour lemons into lemonade and finished 2021 with impressive results.

PagBrasil’s mission is to provide inclusive solutions and redefine the traditional digital payment experience. If you want to be part of this payment revolution in 2022, contact our team!