When opting to sell cross-border, merchants must give consumers the opportunity to pay using their preferred payment method. While more developed economies enjoy near universal financial inclusion and most consumers pay with their credit or debit cards, the scenario changes in emerging markets.

In Brazil, for instance, there are 55 million unbanked adults. In addition, as of January 2019, 60.1% of Brazilian households had some sort of debt, with 22.9% of them defaulting on payments and 9.1% stating they cannot pay their debts. Credit cards are the main source of debt for 78.4% of Brazilian households. Because of that, many consumers prefer alternative payment methods that enable anyone to pay, regardless of having a bank account or credit to their name.

Boleto bancário is by far the most used alternative option in Brazil. But can international businesses offer boleto bancário as a payment method for their online stores? The short answer is yes.

What is boleto bancário?

If you are looking to sell in Brazil, you have probably heard of boleto bancário. But what exactly is it?

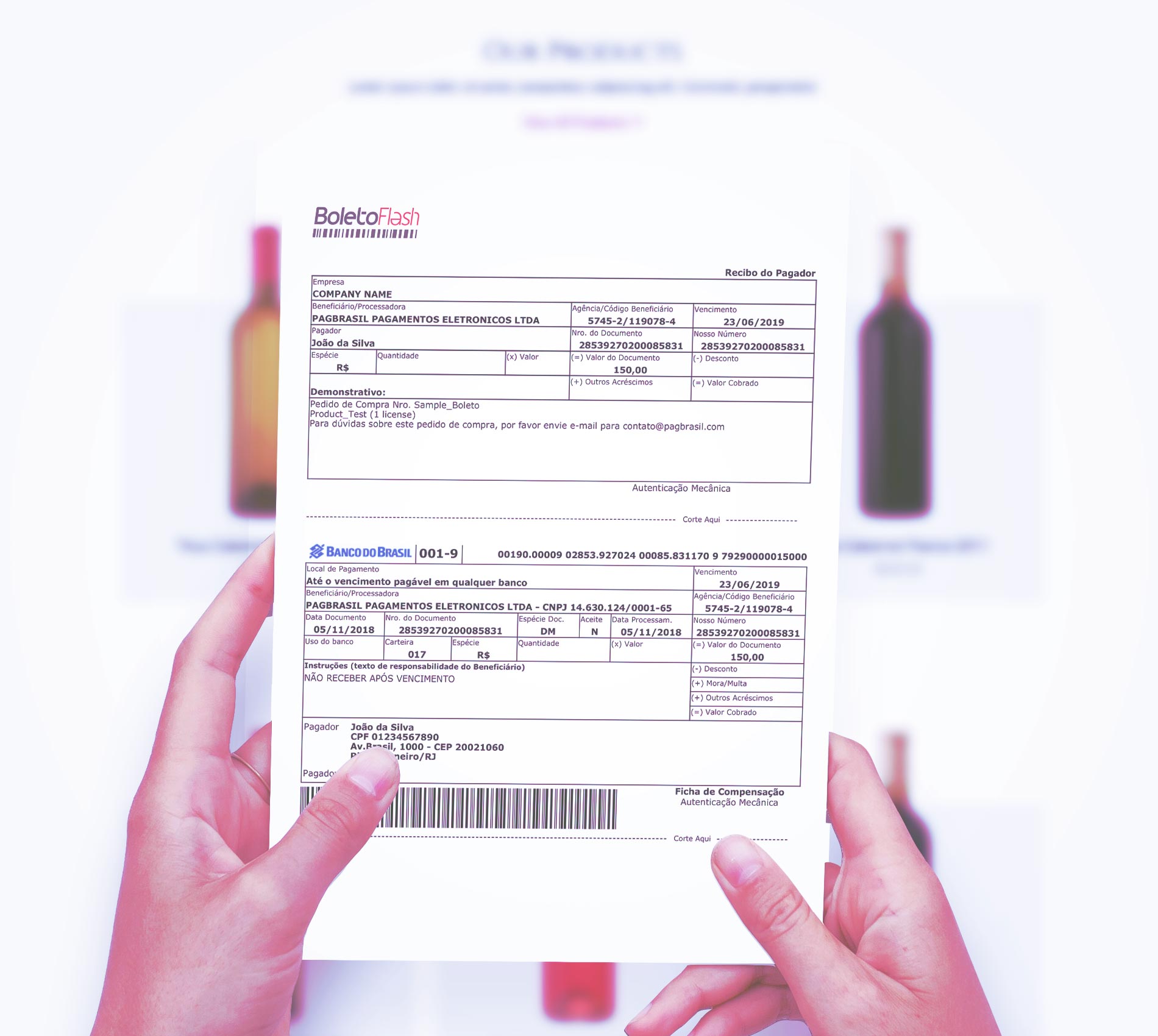

Boleto bancário is an official Brazilian payment method regulated by the Central Bank of Brazil. Launched in 1993, this push payment system has survived the advance of e-commerce and continues to be relevant nowadays. In fact, 3.7 billion boletos are paid every year in Brazil. That’s more than 10 million each day.

The process of paying a boleto bancário is similar to that of wire transfer or cash payment methods. It is a two-step payment, which requires an action on the consumer’s side to finalize the transaction. Buyers are provided with a pre-filled payment slip, which they can either pay physically or electronically. Payment can be made with cash at any bank branch or at authorized entities such as lottery agencies, drugstores, supermarkets and post offices. The electronic payment can be made at any ATM or through internet banking or mobile banking apps.

How can international businesses receive boleto bancário payments?

International businesses that do not have a local entity cannot contract boleto bancário directly with Brazilian banks. However, they can partner with local payment facilitators working with cross-border merchants, such as PagBrasil, who can intermediate the payment. PagBrasil can process payments in boleto for cross-border businesses selling either physical or digital goods, as well as services.

Advantages of processing boleto payments with PagBrasil

PagBrasil has created the exclusive Boleto Flash®, which comes with a responsive layout and offers payment confirmation in under two hours. With Boleto Flash®, merchants can improve their conversion rates by more than 10% and boost their revenue by 10% to 20%. Other advantages include:

• Automated refund

• Email and SMS confirmation and reminder

• Extendable expiration date

• Compatible with in-app usage

• Real-time registration

• Automated conciliation

To learn more, visit the Boleto Flash® website.

Comments

Olá,

Moro no cadada. Tenho um cliente que mora no brasil. Vendemos cursos de guitarra e fazemos split de 50/50. Hoje vendemos nossos cursos com a Udemy. Recebo meus 50% aqui no canada e meu parceiro recebe os 50% dele no brasil. Por mudanças estruturais da plataforma, vamos deixar a Udemy.

Voces tem tem algum produto similar que possamos usar?

Abraços,

Rob

Oi Rob,

Agradecemos o contato! Nós somos uma processadora de pagamentos, e acredito que você esteja buscando um parceiro para vender os seus cursos, certo? Nesse caso, infelizmente, não conseguimos lhe ajudar. Abraço!

Olá Paula,

Estou procurando um payment gateway que ofereça o serviço que eu comentei (50% das vendas pagas através do gateway vão para meu cliente e 50% para mim). Não um parceiro para vender cursos.

Rob

Oi Rob,

Certo! Neste caso, pedimos que preencha o nosso fomulário para que nossa equipe comercial entre em contato: https://www.pagbrasil.com/pt-br/suporte/

Um abraço,