Fintech companies are disrupting the financial industry worldwide. The Brazilian market has shown itself to be very receptive to these innovative companies. In 2017, there were 40% more fintech businesses in the country than in the previous year. Taking into account the timeframe between October 2017 and May 2018, the number increased by 22%, reaching a total of 377 fintech companies. But what exactly is fintech and how have fintech providers become so popular in recent years?

What is Fintech?

Fintech (financial technology) describes, in broad terms, an emerging financial services sector in the 21st century. Originally, the term referred to technology applied to the back-end of established consumer and trade financial institutions.

However, in the past few years, the term has evolved and now describes any technological innovation in the financial sector, including those innovations in financial literacy and education, retail banking, investment, payment and remittance, and even crypto-currencies such as bitcoin. As a result, consumers are increasingly aware of fintech as part of their daily lives, and according to EY’s Fintech Adoption Index, one-third of consumers use at least two or more fintech services frequently.

What is the Fintech Segment Like in Brazil?

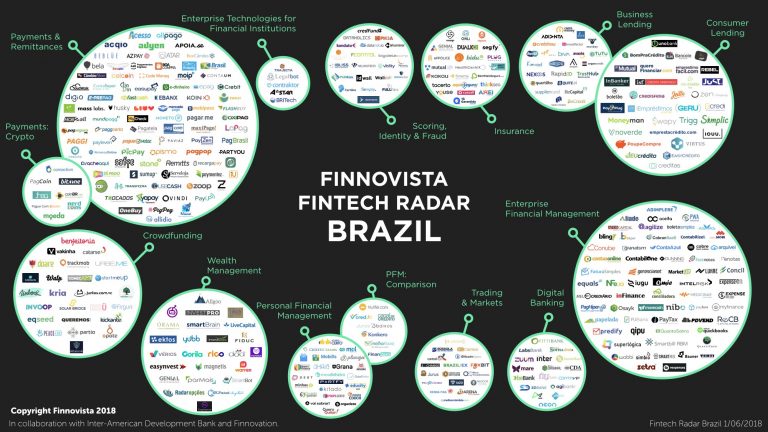

The image below illustrates the fintech landscape in Brazil:

Payment and remittance fintech businesses, the segment where PagBrasil is positioned, take the leadmaking up 25% of the total number of fintech companies in Brazil. Lending fintechs also merit a mention. They make up 15% of Brazilian fintechs and offer consumers more cost-effective alternatives to get access to credit, which is historically expensive in the country.

With a huge unbanked population, it is no surprise that 35% of the Brazilian fintech companies focus on providing services for these consumers, aiming to drive financial inclusion in the country. Furthermore, 28% of the fintechs provide services for the B2B segment.

How Have Fintech Companies Become Popular?

Technology is constantly changing and that is bound to affect how we interact with financial services. In a fast-paced world, consumers’ expectations are very high and traditional financial institutions often fail to take this into consideration and to promote changes.

Fintech companies are generally born to close the gaps in the financial industry and provide a better experience for the consumer. For this reason, they have become so popular and, in many cases, very successful businesses.

PagBrasil, as a payments fintech, is committed to promoting changes in the payments industry, particularly in the e-commerce environment, focusing on delivering the best experience for merchants and consumers. Our payments platform was carefully tailored to the particularities of the Brazilian market. For instance, let’s take our exclusive Boleto Flash® as a reference.

The boleto bancário is extremely popular in Brazil and has been around for 25 years. However, the more the e-commerce industry gained relevance, the more evident it became that the local payment method was outdated and not keeping pace with the market needs. For starters, its layout was not responsive, and the payment confirmation generally had delays of 3 business days. Our Boleto Flash® provides a solution for both issues. Not only can it be easily visualized on any screen size, it also facilitates the payment on mobile devices, both in-app or via mobile banking. Additionally, it is the only boleto in Brazil that accelerates the payment confirmation, reducing the timeframe to less than two hours.

Consumers are bound to become more and more demanding as technology continues to evolve and the fintech companies are expected to continue disrupting the financial sector adding more value to consumers. At PagBrasil, we are well aware of that and have new innovative products and services coming out soon. Follow us on LinkedIn and be the first to hear about them.

Comment

Thanks a lot for the article post.Much thanks again. Fantastic.