The conversion funnel is one of the main concerns for e-commerce businesses. A lot of effort and budget share often go into attracting consumers to the online store and every sale that is not completed reduces merchants’ profit margins. During the first half of the year, the average conversion rate of the Brazilian e-commerce market was 1.3%, according to the study E-commerce Radar by Atlas. In some cases, the sale is lost because of the chosen payment method. For instance, alternative payment methods, such as boleto bancário, have lower conversion rates than credit cards. The main reason for this is because it doesn’t create an automatic charge. Instead, the boleto requires buyers to take action to complete the payment.

The study pointed out that boleto bancário was responsible for 34.5% of the payment transactions. However, out of the boletos generated, only 49% were paid. Here we aim to help merchants understand why only one in two boletos are paid and how to further drive conversions for boleto payments.

Main Reasons for Poor Boleto Conversion

The boleto bancário is an excellent way of reaching a bigger portion of local consumers in Brazil. With a high number of unbanked adults as well as people with a bad credit score – who ultimately cannot own a credit card, the alternative payment method ends up bringing these people closer to the e-commerce environment. However, some factors affect the boleto conversion, such as:

- Non-mobile friendly technology: as the local payment method was launched by the Brazilian Central Bank in the early 90s’, it is not generally optimized for e-commerce and least for its visualization and payment on mobile devices. With the increase of people connecting to the internet mostly via smartphones and m-commerce representing over 30% of e-commerce transactions, the fact that the boleto bancário is often not responsive contributes to a poor conversion rate.

- Difficulty to access the boleto link: when the buyer opts to pay by boleto, many shops only show the link at the checkout page. This influences the conversion rate because many consumers do not pay the boleto at the moment it is generated nor print it to physically pay it later. Therefore, if there is no other way for them to easily access the boleto link, there will certainly be a higher number of incomplete payment transactions.

- Consumers forget to pay the boleto: as it is common to give a few days for buyers to pay the boleto, many consumers generate the pay slip and end up forgetting to pay it prior to the expiry date. Another issue here is that usually boletos bancários cannot be retroactively extended, which would require the buyer to generate a new one to complete the payment, further reducing the conversion rate.

How to Further Drive Boleto Conversion

Despite the issues mentioned above, there are several ways online businesses can further drive boleto conversion. In this scenario, it is important for e-commerce owners to choose the right boleto provider. Some businesses opt to integrate the payment method directly with a Brazilian bank. However, there are a series of advantages of integrating boleto payments with a payment service provider. PagBrasil, for instance, has several features and services aimed at increasing boleto conversion:

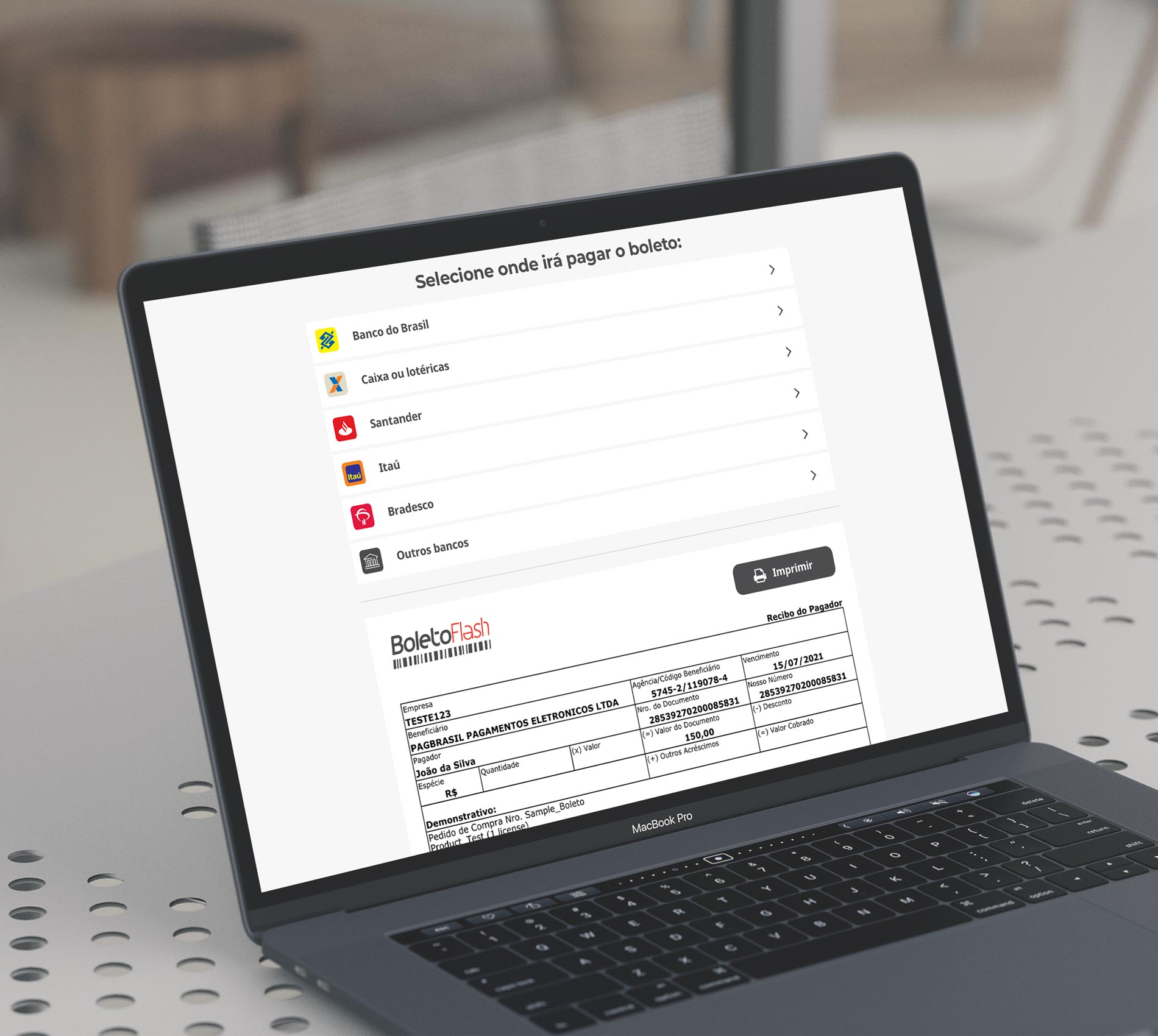

- Responsive boleto: PagBrasil has developed an exclusive responsive technology for its Boleto Flash® and Boleto Express. Thanks to that, the boletos are mobile friendly and can be easily visualized and paid on mobile devices. The technology also allows buyers to easily copy the boleto payment information and finalize the payment via internet banking. When rotating the device, a barcode is displayed and can be used for payments at any ATM with a barcode reader compatible with smartphone screens.

- Faster payment confirmation: a downside of the boleto is that it is often confirmed with a delay of two to three business days. Both boletos provided by PagBrasil offer accelerated payment confirmation. Boleto Express is confirmed the next business day until 10am BRT. On the other hand, Boleto Flash® is the only boleto on the market that offers same day payment confirmation, in under two hours.

- SMS and Email service: aimed at solving the problems of difficulty in finding the link and consumers forgetting to pay for the boleto, PagBrasil provides an additional service that automatically sends both the order confirmation and payment reminders to the buyer. They can be sent by email or SMS and the text is completely customizable. The message always includes the boleto link, which is key to improve the conversions. It is worth highlighting that as emails can end up in spam mailboxes, the SMS alternative often works well as a reminder. Furthermore, if for some reason the buyer fails to pay the boleto before its expiry date, PagBrasil offers a way for merchants to retroactively extend it.

For more information about how to improve boleto conversion or to learn more about PagBrasil’s Boleto Flash® technology, contact us.