Brazil is just a few weeks away from launching Pix, the Central Bank of Brazil’s instant payment platform that will be available to the population on November 16th.

By October 5th, financial institutions had already started registering the Pix keys, which will allow users to send and receive payments using only the cell phone number, e-mail, CPF – the Brazilian individual taxpayer’s registry identification – or a random key. In addition to the Pix key, users can also make a payment by scanning a QR Code with the bank or digital wallet app installed on their smartphones.

It is worth reminding everyone that Pix will have no cost for payers and will enable payment confirmation in an average of 2.5 seconds. In addition, the payment method will also be available 24 hours a day, 7 days a week, including Saturdays, Sundays, and public holidays.

But how will Pix work in ecommerce? What will the payment experience be like for online shoppers in Brazil? And more importantly: how can merchants offer this payment method on their websites? This is what we will explain in this post. Check it out!

Read also: Pix: 10 questions and answers about Brazil’s instant payments

The payment experience with Pix in ecommerce

After all, how will Pix work on the online store’s checkout page?

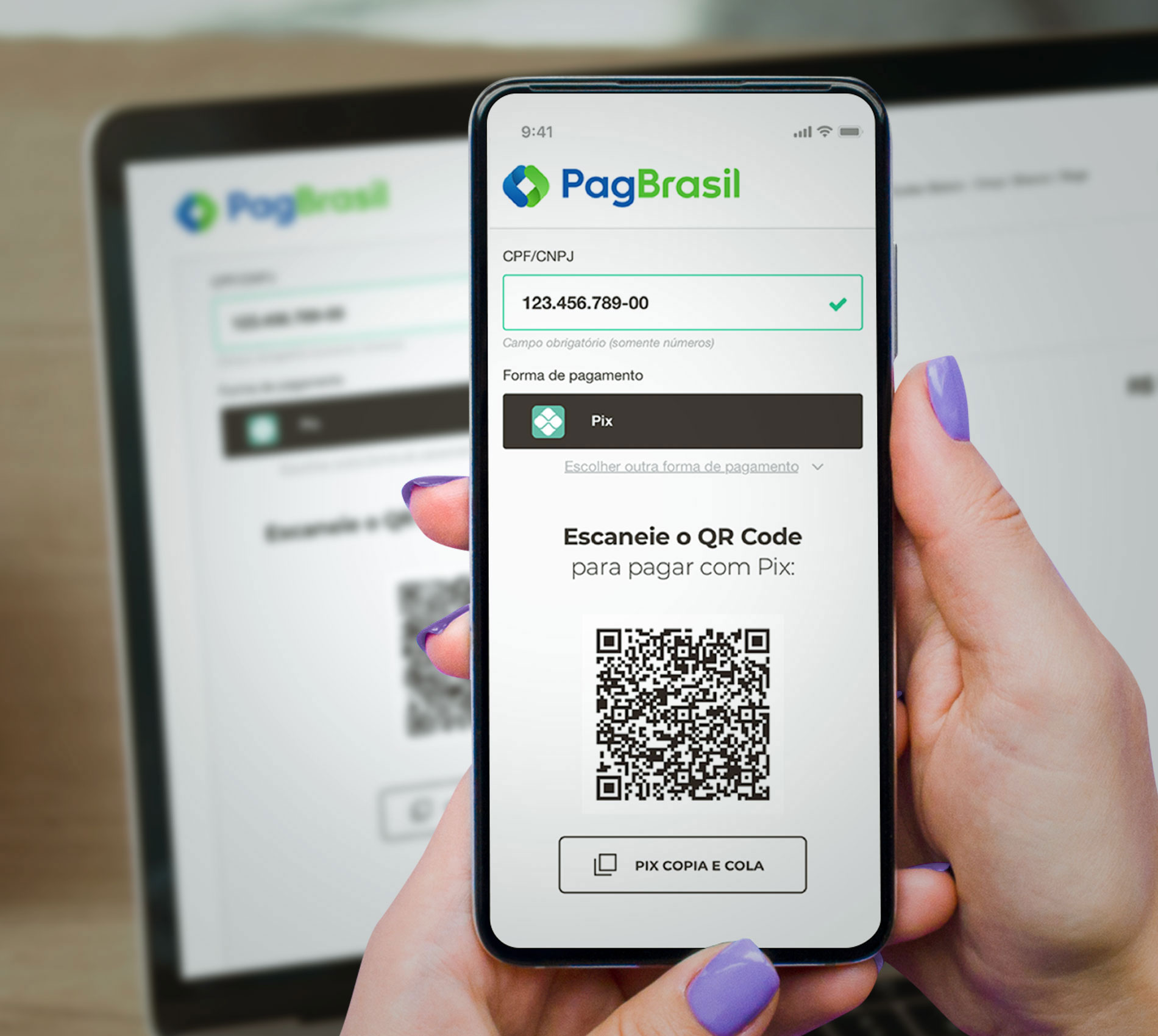

There are two possible situations. When the purchase is made in the mobile environment and the user chooses to pay with Pix at the checkout, a code will be displayed. The user then copies the code, opens the internet banking ou digital wallet app to pay with Pix, and selects “Pix Copia e Cola” to paste the code and confirm the transaction.

For ecommerce transactions initiated on a computer, the user will be able to pay in a similar way to physical stores. When selecting Pix at checkout, a QR Code will be displayed on the computer’s screen. Users can simply open the bank or digital wallet app on their smartphones and scan the code. The details of the transaction will be displayed on the smartphone’s screen and users can complete the operation on their mobile devices.

How can merchants offer Pix in ecommerce?

The merchant who wishes to offer this payment method in their ecommerce websites do not need to connect directly to Pix as a direct or indirect participant – this is the role of financial institutions, such as banks and fintech companies.

To offer Pix, merchants must have a payment account at a financial institution connected to Pix, such as a Payments Service Provider (PSP). Just use one of the solutions offered by the service provider, such as collection on a gateway.

Also, if the merchant uses an ecommerce platform – such as Shopify, Woocommerce, Magento, or VTEX, among others – it is possible to integrate with a payment processor that has a module, extension, or plug-in dedicated to the platform in question.

It is important to note that the cost to receive a Pix in ecommerce has not yet been defined. Prices will not be determined by the Central Bank of Brazil, but by the market itself. However, as Pix encourages competition among players in the financial market, the expectation is that prices will also be more competitive – especially when compared to other cash payment methods, such as the boleto bancário.

Is Pix safe?

For those who question whether Pix is safe, the answer is: yes, it is! Since the user needs to authenticate the transaction before confirming the payment, the amount will reach the recipient without complications.

In addition, the Pix key registration process also requires a two-step authentication – such as confirmation via SMS or e-mail -, which strengthens security.

Watch the webinar: the impact of Pix in ecommerce and payment methods

On October 1st, our CEO and co-founder, Ralf Germer, participated in a webinar with Paulo Andreoli, Ambassador of Pagos, and Alex Barreto, Legal and Regulatory Compliance Director at banQi. The webinar covered how Pix will work and the impact on ecommerce and payment methods. Watch below (in Portuguese)!

Do you want to receive more content like this via email and stay up to date with all our webinars? Subscribe to our newsletter!

This content was updated on November 16, 2020

Comments

Excelente WEBINAR sobre o PIX. A comparação com o Iphone lançado em 2007 foi muito inspirador. Parabéns aos participantes.

I need to make a transfer