Selling online has never been so important. In Brazil, digital actions such as shopping and entertainment have been growing year by year with the fast adoption of mobile devices. We can understand why: with 94% of internet users in Brazil owning a smartphone, digital habits are naturally encouraged as users realize their benefits and practicality.

But even in a dynamic, quick and easy environment, selling online is still challenging, and merchants must find ways to expand their reach and deliver a positive shopping experience. For that matter, enabling a payment link is an effective strategy!

Understand how it works

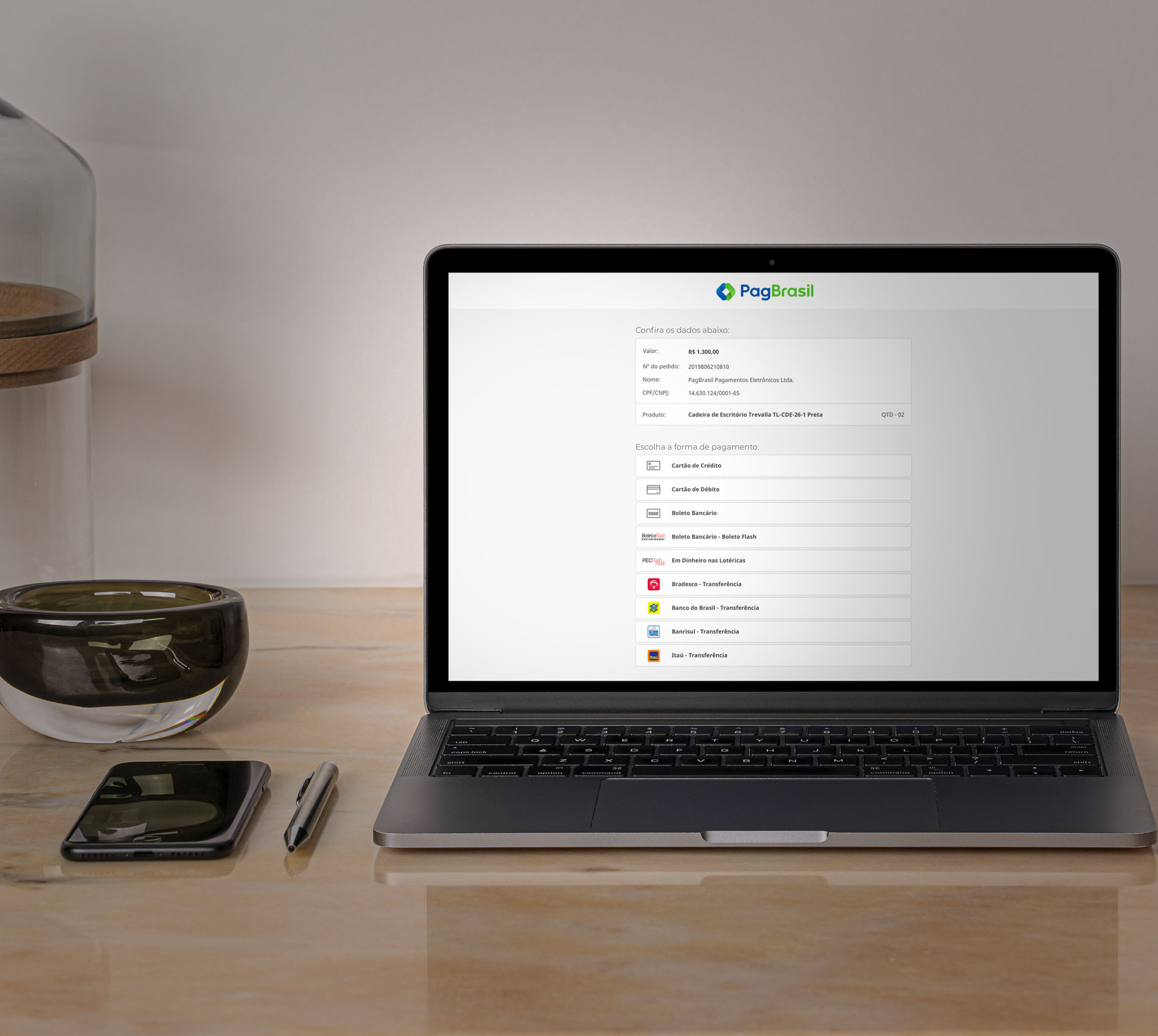

This payment model enables merchants to send a link for customers to complete a purchase without the need of accessing an online store. It requires no integration, which means it is possible to start processing payments right away. In addition, consumers may choose from a large set of payment methods, such as credit and debit cards, boleto bancário and the exclusive Boleto Flash® and PEC Flash®.

4 benefits of the Payment Link

This payment solution adds a number of benefits to merchants, as it enables multichannel sales and helps recover abandoned carts. We’ve listed below how the payment link may help businesses boost their sales. Check it out!

1. Sell in multiple channels

Brazilians spend an average of 03 hours and 31 minutes on social media. In addition, 96% of internet users in Brazil use chat apps, such as WhatsApp. With such high usage, enabling quick and easy payment solutions is an effective strategy to increasing conversion rates.

With the payment link, merchants may simply send the URL to their customers through private messaging channels, providing an excellent shopping experience.

2. Doesn’t require an online store

The payment link is also a flexible solution for merchants who don’t have an ecommerce infrastructure. Since the solution doesn’t require a technical integration, merchants that would usually rely on in-store payment methods, such as POS machines or cash, may complete their sales remotely by sending the customer the URL by email, SMS, or messaging apps.

3. Enables second conversion opportunities

The payment link can be used to recover abandoned carts, as merchants may send an updated URL to customers encouraging them to complete the purchase. In addition, it can also be used for recurring payments and remarketing strategies.

4. Flexible and customizable

To top it off, the payment kink is both flexible and customizable. Merchants may generate a pre-filled link with previously saved customer information and benefit from a mobile responsive layout. In addition, it is also possible to add a customized message to the footer of the payment page.

PagBrasil’s Payment Link

Our solution supports a full set of services and features, providing customers with a wide range of payment methods and an excellent shopping experience. Learn more about PagBrasil’s payment link solution or reach out to us for further details!