Brazil has revolutionized its payments landscape with Pix, the instant payment method used by 93% of the population and accepted virtually everywhere—from major retailers to local street vendors. Today, Pix is the preferred method of over half of the country’s adults, demonstrating just how profoundly it has transformed the way Brazilians pay and get paid (Valor International).

Yet one group has remained outside this revolution: the millions of tourists who visit Brazil each year. Between January and September of this year, more than 7 million tourists visited Brazil—the highest number ever registered, according to Embratur. Until now, these travelers have relied on credit cards or cash, often facing unfavorable exchange rates, extra fees, and acceptance barriers. This experience is a sharp contrast to the seamless one enjoyed by locals ever since Pix entered the scene.

PagBrasil’s Pix Roaming bridges that gap. As the first and only solution enabling foreign users to pay with Pix in Brazil directly through their home banking or wallet app, it connects international customers with Brazilian retail like never before. This article explores how Pix Roaming empowers global banks and wallets to join the Pix ecosystem, expand their service offerings, and lead the next phase of cross-border payment innovation.

What Is Pix Roaming?

Before discussing the benefits of Pix Roaming, it’s important to understand Pix, the innovative payment system it is built on.

Pix is Brazil’s popular instant payment method, launched by the Central Bank of Brazil in 2020. It allows people and businesses to send and receive money in seconds, 24/7, directly from their bank account. Pix has transformed the Brazilian payments landscape, becoming the dominant way to pay and get paid across the country. Its speed, convenience, and ubiquity make it one of the most advanced instant payment systems in the world—even drawing global attention (The New York Times).

Pix Roaming builds on this innovation by extending Pix’s capabilities to international users. It allows tourists to pay using any Pix QR code or digital key in Brazil using their own banking or digital wallet app, without having to open a local bank account or exchange currency. Payments are instant, secure, and automatically converted into Brazilian reais, providing a seamless experience for both users and merchants.

But Pix Roaming’s reach doesn’t stop there. Beyond Brazil, the technology illustrates a model for global payment interoperability. As Pix’s presence expands to other countries, tourists from all over the world will be able to use the Brazilian payment method outside of Brazil, too. Thanks to PagBrasil’s partnership with Verifone in the U.S., for example, Argentinian visitors will be able to pay with Pix during the 2026 FIFA World Cup.

This is all made possible through PagBrasil, which acts as the strategic and technological bridge for international banks and wallets. We handle all regulatory, operational, and settlement requirements, enabling a turnkey solution that connects cross-border institutions to Brazil’s Pix ecosystem quickly and efficiently.

What Is the Scale of the Opportunity Unlocked by Pix Roaming?

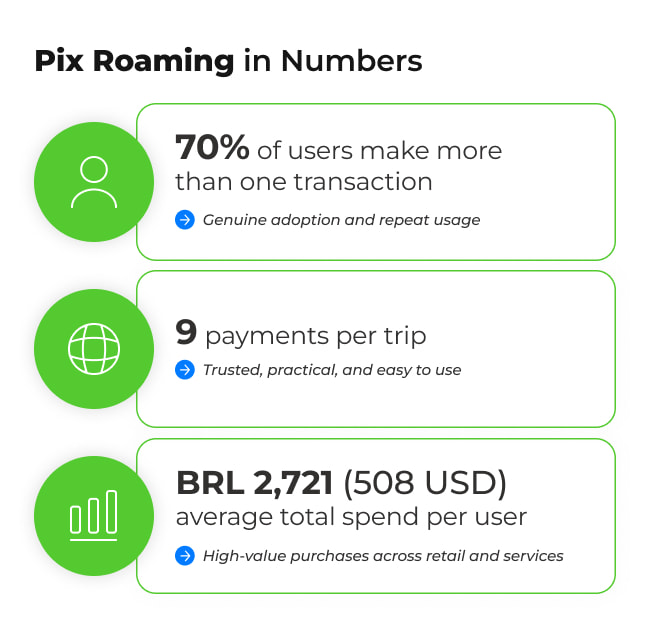

Pix Roaming is more than a convenient way for tourists to pay; it’s proof of a strong, recurring demand for instant, digital-first payments among international travelers. The following insights illustrate how users are not only trying the solution but adopting it as their preferred way to pay throughout their stay in Brazil.

Genuine Adoption Demonstrated by Repeat Usage

Pix Roaming users don’t just make one-off transactions—they come back to use it again and again. On average, each person makes 9 payments during their trip. This level of repeat usage shows that travelers find Pix Roaming practical, reliable, and easy to use. Once they try it, they quickly integrate it into their daily spending in Brazil, from dining and shopping to entertainment and transportation.

Growing and Engaged User Base

Nearly 70% of Pix Roaming users make more than one transaction, and over 30% complete more than five payments during their stay. Remarkably, almost one in ten users surpass 20 transactions, showing consistent engagement across their entire trip.

Such behavior goes beyond curiosity, signaling sustained trust and satisfaction with the experience. For international banks and wallets, this engagement reflects a clear opportunity to deepen relationships with customers through a payment experience they value and actively use.

High Spending Power and Conversion Potential

Pix Roaming also unlocks meaningful transaction value. The average total spend per user reaches BRL 2,721 (508 USD), with the average total spend per transaction hitting BRL 313 (USD 59). This indicates that travelers are not only adopting Pix Roaming but are confident enough to use it for higher-value spending.

For financial institutions, this demonstrates both monetization potential and cross-border FX opportunity—each transaction processed through Pix Roaming keeps revenue within their own ecosystem while providing travelers with transparent, instant payments in local currency.

Approved by End Users

Beyond strong adoption metrics, user feedback has been overwhelmingly positive. Travelers highlight Pix Roaming’s ease of use, instant confirmation, and security as major advantages compared to traditional payment methods. For many, it’s the first time they’ve experienced truly frictionless payments while abroad without worrying about currency exchange or card acceptance issues.

This positive response reinforces Pix Roaming’s value proposition for financial institutions. When customers associate their home banking or wallet app with a smooth, modern, and borderless payment experience, it strengthens trust and long-term loyalty.

Why Is Offering Pix Roaming a Strategic Advantage for Your Bank or Wallet?

For international banks and digital wallets, Pix Roaming is a strategic gateway into one of the world’s most dynamic payment ecosystems. By partnering with PagBrasil,

institutions can deliver a seamless local payment experience for their traveling customers, strengthen loyalty, and tap into Brazil’s thriving retail market. The advantages go far beyond convenience, opening new possibilities for growth, differentiation, and cross-border monetization.

Gain Immediate Access to the New Retail Markets

Through a single partnership with PagBrasil, international banks and wallets can instantly connect their users to almost every commercial establishment across Brazil, as well as any other country that accepts Pix payments, such as the United States, Argentina, Chile, Peru, Uruguay, and Spain. There’s no need for individual integrations, local licensing, or operational setup, as PagBrasil manages all the regulatory, technical, and settlement layers behind the scenes.

This means your customers can pay at virtually any point of sale using a Pix QR code or payment key, using the same app they rely on at home. For financial institutions, it’s a way to enter diverse payments landscape overnight, with minimal resources and maximum scalability.

Improve the Experience and Loyalty of Your Traveling Customers

Offering Pix Roaming transforms the way your customers interact with local merchants while visiting Brazil. Instead of dealing with cash, currency exchanges, or credit card acceptance issues, travelers can pay instantly and securely with the app they already trust.

Providing this seamless experience not only enhances convenience but also positions your institution as a forward-thinking partner that anticipates and meets customer needs. By reducing friction in payments abroad, you strengthen engagement, encourage repeat use, and differentiate your services from competitors who offer only traditional cross-border payment options.

Create New Revenue Streams with Cross-Border Payments

Pix Roaming opens up an entirely new channel for monetizing cross-border transactions—one that replaces traditional cash exchange and credit card payments with a digital alternative that offers higher margins and lower costs.

Each payment made via Pix Roaming represents an opportunity for revenue generation through the currency conversion process, without the percentage-based transaction fees typically charged by card networks. This means institutions can capture more value from every transaction while offering customers a faster, more transparent payment experience.

Pix Roaming also transforms the way foreign exchange is sold. The same volume that tourists would traditionally convert in cash at currency exchange houses can now be processed directly within the bank’s or wallet’s own app, strengthening the institution’s relationship with its customers and keeping that revenue within its ecosystem.

Finally, in a landscape where cross-border digital wallets are rapidly expanding, adopting Pix Roaming allows banks to stay competitive, diversify revenue streams, and capitalize on the growing digitalization of global travel payments.

How Can Financial Institutions Enable Pix Roaming?

Integrating Pix Roaming into your banking or wallet services is designed to be agile and hassle-free. PagBrasil handles all the complexity of connecting to Brazil’s Pix ecosystem, including regulatory compliance, operational requirements, and technical integration. This means your institution can offer Pix payments to international customers without building local infrastructure or managing the intricacies of the Brazilian payment system.

Transactions are processed securely and transparently, with PagBrasil’s proprietary technology guaranteeing the original USD amount and exchange rate. Customers see consistent, predictable payments, while banks and wallets can focus on what they do best: serving their users and delivering a superior experience.

By partnering with PagBrasil, institutions gain a turnkey solution that removes operational friction, ensures regulatory compliance, and allows them to enter the Brazilian payments market quickly and efficiently, all while providing a seamless experience for their customers.

Ready to Bring Pix Roaming to Your Customers?

Pix has transformed payments in Brazil, creating a seamless, instant, and widely adopted system. Pix Roaming brings this revolution to the rest of the world by allowing international banks and wallets to offer their customers a trusted, frictionless way to pay across Brazil—and setting the stage for future cross-border interoperability.

Speak with one of our specialists today to discover how Pix Roaming can enhance your service offerings, strengthen customer loyalty, and unlock new revenue opportunities.