In the past few days, Brazil has been facing the advancement of the COVID-19 pandemic, which has caused the first impacts on the country’s public health structure and concerns the national economic scenario. As China – the epicenter of the disease – begins to resume its activities after months of quarantine, and as European countries take steps to stem the spread of the virus, we now have a clearer understanding of how the situation is evolving in various sectors – including digitally – and how some markets have gained visibility in this scenario. Check out the changes and opportunities that ecommerce can find in the coming months.

How has COVID-19 affected ecommerce?

Supply and shipping chains have been significantly affected by the lockdown in China, as Alibaba CEO Daniel Zhang has warned. Even before the virus had spread to other countries, businesses worldwide faced a number of problems, due to the outbreak in China.

Businesses that import products from one of the largest suppliers in the world have faced stock problems, leaving many of their own clients unattended. Drop shipping ecommerce businesses have also faced difficulties: since the products are shipped directly from China, the delivery due date has also been affected.

However, some segments have seen a significant increase in the demand for basic consumer goods, such as hygiene and cleaning products. According to the Neil Patel website, sectors such as finance, food, health, media, and pharmaceuticals have seen up to a 35% increase in their websites. The same survey also shows a nearly 60% increase in online conversions in the food segment.

As the Chinese production is being resumed, the supply of goods is being normalized, thus minimizing the impacts faced by the international chain that relies on it. These and other challenges have impacted ecommerce businesses around the world.

Health supplies sales increase over 160%

The numbers are changing! What started out with a slight decrease in the national market in general now sees a positive curve on online consumption in select segments. In February 2020, ecommerce sales in Brazil saw a 7.7% decrease when compared to January, according to research carried out by Compre & Confie. This result is due to the caution of digital consumers, who are avoiding shopping from cross-border online stores based on countries most affected by COVID-19.

On the other hand, health supplies such as inhalers and nebulizers have seen a 177.5% increase. Alcohol gel sales grew by 165% in February.

Further, it is safe to say that, as the virus continues to spread and governments worldwide orient their populations to stay home, some ecommerce categories will grow, especially in segments such as food and beverage, and pharmaceuticals.

Digital shopping encouragement

With the advance of the disease, the population is encouraged to stay at home in order to mitigate the contagion. This will eventually increase digital reliance, as delivery services are the best alternative to shopping for goods while also avoiding crowded spaces.

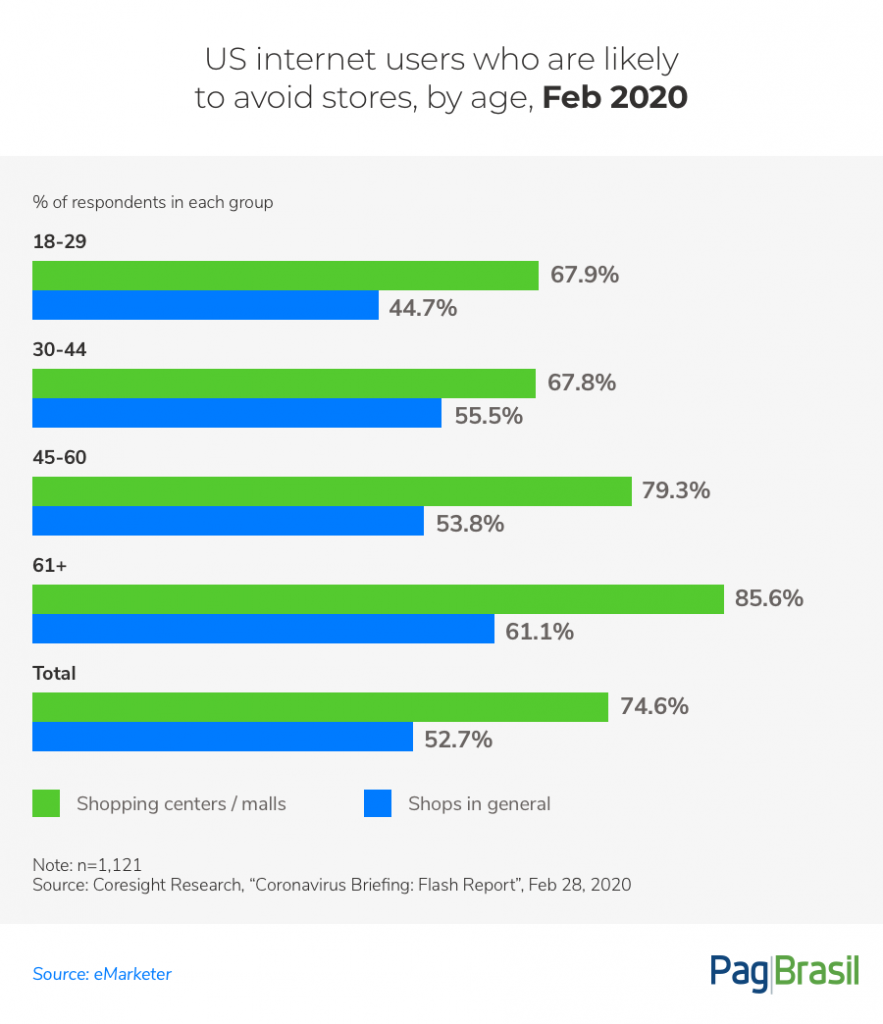

According to research carried out by Coresight Research in the United States, the population is turning to ecommerce as an option to obtain basic supplies. In the country, almost half (47%) of consumers consulted at the end of February said that they are avoiding shopping in malls, and 32% are avoiding physical street stores. The fact that consumers are distancing themselves from physical purchases does not mean that consumption has decreased; it has only migrated to digital media.

There have been surges in Amazon searches for products such as hand sanitizers and antibacterial soap, as reported by eMarketer. To avoid going to stores, consumers – especially the elderly – are more willing to purchase online, even if this means an extended delivery time.

In China during the outbreak, more than half of consumers (55%) used ecommerce platforms to supply themselves, according to a survey by consultancy Kantar in more than 1,000 Chinese homes. The quarantine encouraged collective purchases in the country. According to the survey, WeChat, a messaging application similar to WhatsApp but with more features, is considered by 35% of Chinese families as a new shopping channel, allowing customers to shop collectively and exchange products.

Brazil will follow a similar path: according to a survey carried out by NZN Intelligence, 71% of Brazilians said they intend to increase the online shopping volume. Products such as hygiene (80%), food and beverage (72%) and medicine (63%) will be the main focus during this period.

However, this newly introduced habit for sporadic digital customers, who are now encouraged to increase their online consumption, must be seen carefully by the market, as challenges with delivery due dates, supply chain and logistics are most likely to appear.

Online opportunities in Brazil

The first case of COVID-19 in Brazil was reported on February 25th. With the recommendation to stay at home and avoid crowds, Brazilian ecommerce can find an opportunity to strengthen and continue to encourage the local economy, despite the many uncertainties. Retailers in all segments are taking steps to encourage digital consumption. Magazine Luiza, for instance, has enabled free shipping in their SuperApp for products that help contain the COVID-19 outbreak.

Delivery app iFood said it is too soon to calculate the impact. However, the company has created a BRL 50 million fund for local and small businesses and anticipates receipts from restaurants operating on the platform. In addition, a BRL 1 million fund has been created to support drivers that are unable to work due to COVID-19. Further, the app has initiated no-contact delivery tests in order to contain the virus.

To encourage people to stay at home, telecommunications company Claro announced that broadband subscribers will have their internet speed gradually increased. In addition, pay-TV channels will be released free of charge, including news, film, sports and other channels.

The demand for online gaming options and streaming services is also expected to increase markedly, as the population is looking for home entertainment options.

How digital consumers in Brazil will continue to react to this scenario – and ecommerce businesses will act in light of high demand – is something we will learn as the number of cases and restrictive measures increase. However, the horizon shines positive nuances in strategic online markets that should contribute to the Brazilian economy active.