In 2018, the popular alternative Brazilian payment method known as boleto bancário celebrates 25 years since its creation. Widely used in the country for different types of payments, from university tuition to the purchase of goods and services (both on B2B and B2C segments), each year 3.7 billion boletos bancários are paid in Brazil, as per data by Febraban. This means that over 10 million boletos are paid on a daily basis in the country.

Although the payment method was created before the popularization of e-commerce, the boleto bancário has remained relevant in Brazil throughout the years and with the advance of the e-commerce segment. Overall, boletos bancários payments account for 25% of all e-commerce payment transactions and nearly 35% of the total transacted.

Why Does Boleto Bancário Remain Relevant?

In a time when the payments industry is evolving so quickly, with new technologies and solutions such as blockchain, e-wallets, and mobile wallets constantly re-shaping the way we interact with money and pay for our consumptions, the boleto bancário has managed to remain relevant for Brazilian consumers.

According to research by Conversion, 57%* of all e-commerce consumers in Brazil choose boleto bancário as their preferred payment method, just behind installment payments, chosen by 63% of the interviewees. Taking this into consideration, it is no surprise that 75% of all e-commerce websites in Brazil offer boleto bancário as a payment method, as reported by SEBRAE.

With an unbanked population of 55 million adults and a high household indebtedness, credit cards are not always an option for Brazilian consumers. In this context, the boleto plays an important integration role, giving millions of Brazilians access to the e-commerce industry.

Furthermore, it is worth pointing out that the boleto bancário has also provided consumers with means to fund their e-wallets and even pre-paid cards, which have become a popular choice among the unbanked population in Brazil. In addition, some banks already allow boleto deposits, which means that account holders can make bank deposits to their accounts by paying the boleto anywhere, avoiding any associated fees. This option can also be used to receive deposits from third parties.

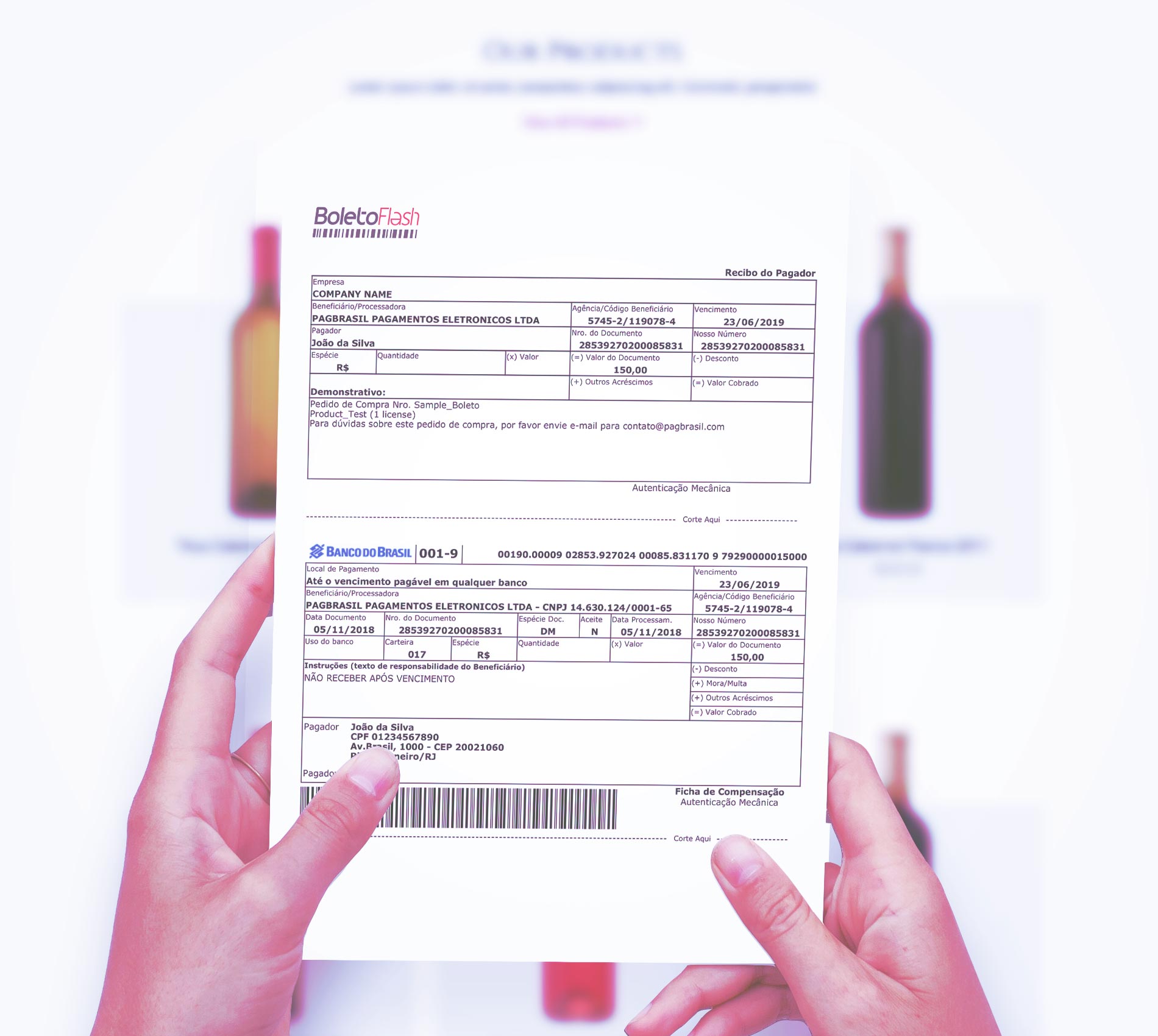

Because of boleto bancário relevance in Brazil, PagBrasil has focused on enhancing its boleto solution. Our exclusive Boleto Flash®, which provides payment confirmation in less than two hours and has a responsive layout, is the result of our efforts to bring the boleto bancário closer to the market’s current needs. To learn more about boleto bancário and our Boleto Flash®, contact us.

*multi-choice question.